Not entirely sure what a merchant ID (MID) number is? Read on to learn more, as well as how to find your merchant ID and what having one means for your business.

What's in this article?

- What is a merchant ID number?

- How merchant ID numbers work

- Why your business needs a merchant ID

- Merchant ID lookup: How to find your MID

- How to get a merchant ID number

- Can you have more than one merchant ID?

- Can you lose your merchant ID?

What is a merchant ID number?

A merchant ID number – commonly called a merchant number or MID – is a 15-digit alphanumeric identifier used to facilitate credit and debit card payments for your business.

How merchant ID numbers work

MIDs are used to identify your merchant account. When the customer submits their payment information at the point of sale and the transaction process begins, the MID ensures that the merchant account is marked as the destination for the funds. As the transaction is processed, the customer's payment information travels alongside the MID as all the key stakeholders – the merchant acquirer, the card issuer and the payment processor – communicate with each other about the transaction. Like the mailing address on an envelope, your MID tells the funds where to go.

Why your business needs a merchant ID

Your business needs a merchant ID number so that your customer payments can travel from the customer's bank account to your bank account. Without a merchant ID number, funds from customer payments would never make it to your bank account.

While every business that accepts card payments needs to have a merchant ID number, not every business needs to obtain one. Depending on which payment-processing provider you use, and which financial institution hosts your merchant account, you might or might not be supplied with a merchant ID number.

Stripe users, for example, don't see or deal with their merchant ID number directly. Since Stripe is a full-service payment processing solution that offers the functionality of a merchant account, our users don't need to open a merchant account on their own and therefore are not given a merchant ID number.

Using the mail metaphor again, all customer payments are sent to Stripe's main mailing address, and Stripe then routes each payment to the correct business. Stripe users can avoid piecing together separate components to create a payment ecosystem, resulting in fewer details to worry about and less stress overall.

Merchant ID lookup: How to find your MID

There is no public database where you can look up your merchant ID number. This is a basic security measure, similar to how your personal bank doesn't publish a list of customer account numbers.

But finding your merchant ID is usually very simple. Here are a few ways to go about it:

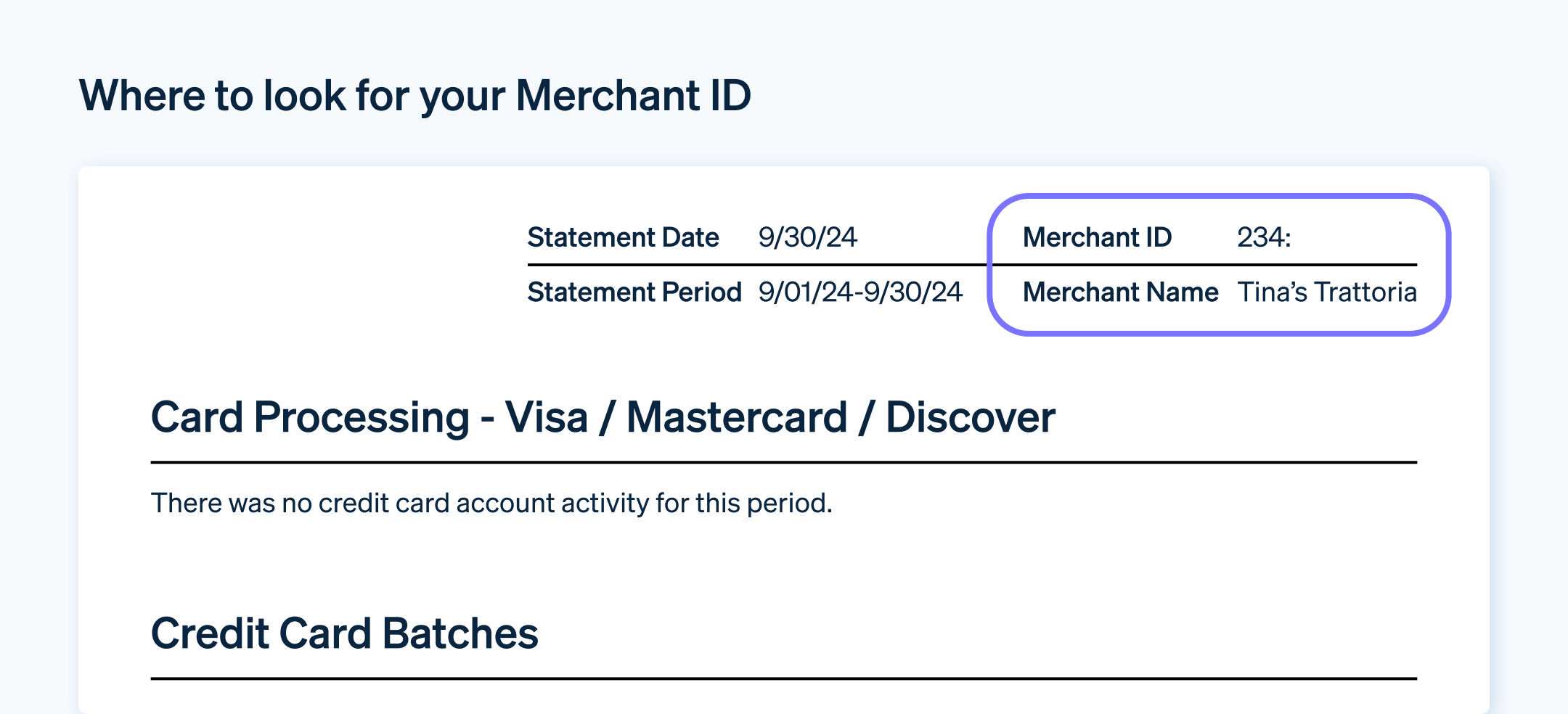

Check your merchant account statement

In most cases, this is the first place you should go to locate your merchant ID number. Look for a 15-digit alphanumeric identifier on the upper right-hand corner of your merchant account statement – that's your MID.Check your payment terminal

Some terminals have the MID listed on them, usually on the side or bottom of the machine.Call your merchant account provider

If you're having a difficult time locating your merchant ID, you can always call your merchant account provider and ask for the information.Check your bank statement

While your merchant account statement will definitely display your MID, your regular business bank account statement might list it in a different form. When you look at transactions from your merchant account, you might be able to find your MID displayed in the description. Note: The number displayed on the statement might be a partial MID and not the full 15-digit alphanumeric identifier, so confirm with another source if you're unsure.

Again, because Stripe provides merchant account functionality, Stripe users will have an overall account ID that identifies their Stripe account, but not an actual merchant ID.

How to get a merchant ID number

When you open a bank account with a merchant acquirer, you'll be assigned a merchant ID. The requirements to obtain a MID are the same as the requirements to open a merchant account. You'll need to go through the verification process, which includes providing materials such as your employer identification number (EIN) and other proof that your business is registered and legally ready to begin operating.

Can you have more than one merchant ID?

While it's possible to have more than one MID, for the vast majority of businesses, one is enough. However, if you own multiple unique businesses that have separate merchant accounts, then you'll have separate MIDs for each one.

One scenario in which a single business might have multiple merchant IDs is if your business contains multiple, distinct revenue sources, and you want to keep different streams of funds in separate accounts for simplicity. For example, if you run an independent cinema that also has a café within it, you might choose to keep separate merchant accounts, and merchant IDs for the theatre and the café, even though they are technically part of the same business.

Can you lose your merchant ID?

Yes, it's possible to have your merchant ID revoked. The most common reason for merchants to lose their merchant ID is having too many chargebacks. If you decide to switch merchant service providers at any point, you will also relinquish your old MID and be assigned a new one by your new provider.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.