In France, a bank account number is an 11-character string that identifies your account among thousands of others at a given financial institution—and it’s a number you shouldn’t share without good reason. But what is it used for? Where can you find yours? And what’s the difference between a banking identity statement (RIB) and an account number? This article addresses the most common questions you might have about bank account numbers.

What’s in this article?

- What is a bank account number?

- What are bank account numbers used for?

- Where can you find your bank account number?

- Example of a bank account number

- Can you share your bank account number?

What is a bank account number?

A bank account number is a unique string of alphanumeric characters assigned to an account at a financial institution. It’s used to identify an account within a bank, and guarantee that funds are directed to the right recipient.

Every bank account in France has its own unique account number. The account number is different from the International Bank Account Number (IBAN), the Bank Identifier Code (BIC), and the Society for Worldwide Interbank Financial Telecommunication (SWIFT) code.

How many characters are there in a bank account number?

In France, there are 11 characters in a bank account number. If the account number is shorter, leading zeros are added to create an 11-character string.

Each alphanumeric string is unique. It’s impossible for two accounts at the same bank to have the same account number.

What are bank account numbers used for?

The primary use of a bank account number is to identify an account among others at a given financial institution. An account number is required to manage money transfers efficiently and securely. It’s also used to perform numerous other financial operations, such as:

- Receiving funds: Sharing your bank account number with a private person, an organization, or a business, allows you to receive funds directly in your account through a bank transfer. You can also use your account number to make deposits and withdrawals, or to cash checks.

- Direct debit payments: To pay your bills automatically, you need to give your bank account number to the creditor. The account number facilitates direct debit payments for subscription services and utility bills, among other things.

- Bank transfers: To transfer funds between bank accounts, you need to specify the number of the account that needs to be charged as well as the number of the account that will receive the funds.

Your bank account number allows banks to keep accurate records of all the transactions made on your account. The account number allows banks to access details, balances, and the transaction history—all while helping them manage the account efficiently.

Where can you find your bank account number?

Your bank account number typically appears on your RIB. The RIB features the bank account number, bank code, branch code, IBAN, and BIC. Your account number is also printed on your checks and inside your checkbook.

Your bank account number appears on your electronic or paper bank statements, as well. You’ll find it in the section above the detailed transaction history for the relevant time period.

You can locate your bank account number online by logging in to your account or by accessing your bank’s mobile app. If you can’t find it, contact your bank’s customer service—they can provide it to you once they’ve verified your identity.

Example of a bank account number

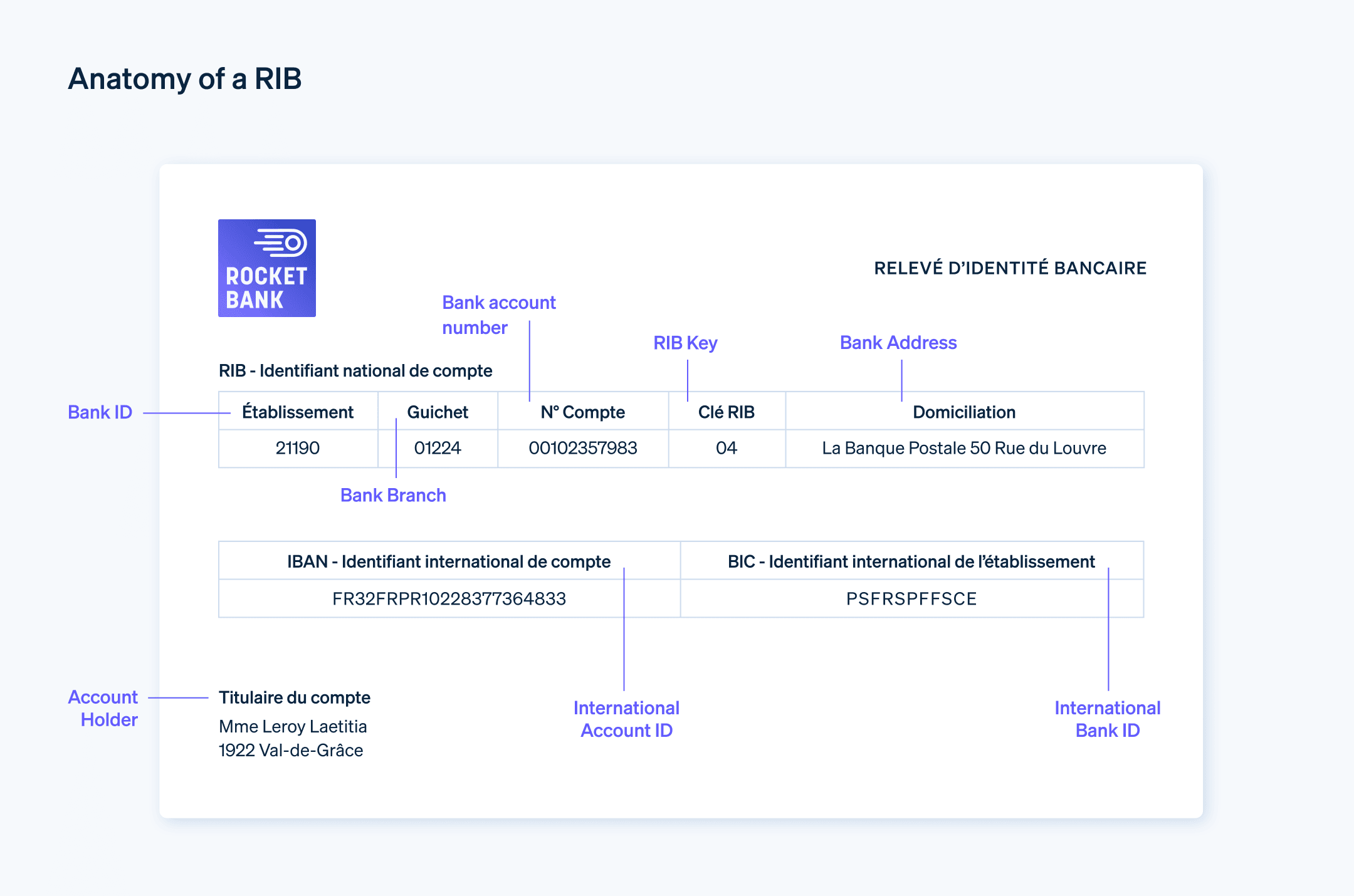

A bank account number appears on a RIB. It’s listed right after the bank code and the branch code.

Can you share your bank account number?

Yes, you can share your bank account number to perform financial transactions, such as paying bills or making recurring payments to a trusted business or institution. As a rule, it’s not possible to withdraw money from your account without your express consent. Anyone who gets access to your account number will only be able to make deposits into your account.

You shouldn’t share your account number without good reason, however. Don’t divulge it to people or organizations whose identities haven't been verified, and monitor your bank account carefully to guard against fraud or identity theft.

You can entrust your payments to Stripe Payments, an integrated payment system designed to boost your conversion rates and reduce fraud risk using advanced AI algorithms.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.