A bank account number is a unique identifier assigned to a specific bank account. Account numbers can vary in length and format depending on the institution or service. For financial transactions, your account number is like your fingerprint, identifying who you are for transactions and account updates.

Globally, 76% of adults had an account at a bank or regulated institution in 2021, according to the World Bank’s most recent survey. This guide will cover what businesses need to know about account numbers and how they work in financial contexts.

What’s in this article?

- How are account numbers used?

- How to find your account number

- Difference between a routing number and an account number

How are account numbers used?

Bank account numbers identify individual accounts within a bank or financial institution. Typically between 8 and 12 digits, they’re used in financial transactions to ensure that funds are added to or removed from the appropriate account. Account numbers are used to facilitate deposits, withdrawals, electronic funds transfers (EFTs), direct deposits, wire transfers, and automatic billing. Account numbers are also used for account management, allowing customers and bank staff to access account information, balances, and transaction history.

How to find your account number

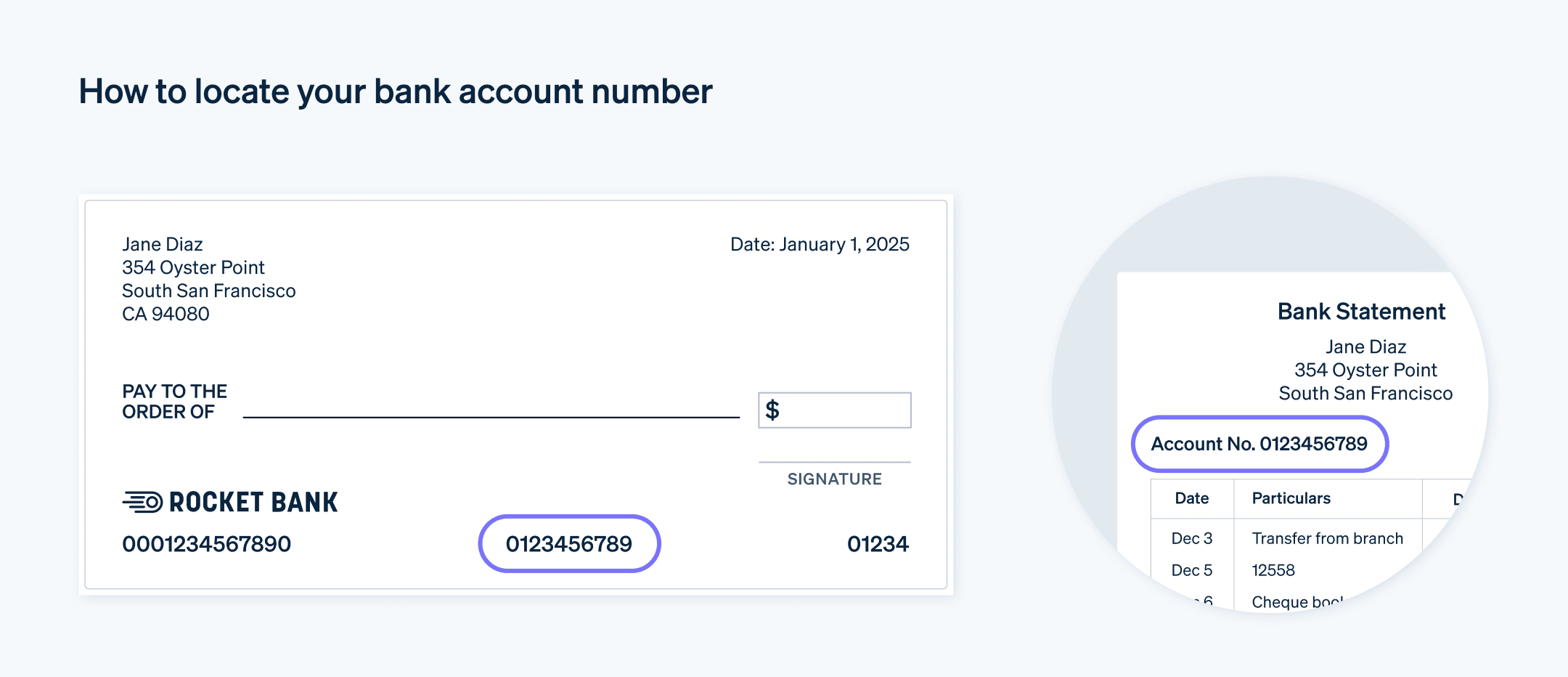

Bank statements: Both paper and electronic bank statements should include the bank account number. Look for a section labeled “account details” or at the top of the document where it indicates the account holder’s information.

Checks: If you have a checkbook, the account number is typically printed on the bottom of each check. It is the second set of numbers between the routing number and the check number.

Online banking: Account numbers are listed on online banking accounts, accessible via website or mobile app. They’re typically listed under “account details,” “account summary,” or “profile settings.”

Bank cards: In some cases, the account number may be printed on debit cards issued by your bank. However, debit cards usually have a card number that differs from the account number.

Bank branch or customer service: If you cannot find your account number through the methods listed above, visit a local bank branch or contact customer service. They can verify your identity and provide your account number.

Difference between a routing number and an account number

Routing number

A routing number is a nine-digit code used to identify a specific financial institution or bank branch within the United States. It is also known as an American Bankers Association (ABA) routing number.

Routing numbers clarify the bank and branch involved in financial transactions such as direct deposits, wire transfers, checks, and Automated Clearing House (ACH) transfers. A single bank can have multiple routing numbers, depending on its size, location, and specific services.

Account number

An account number is a unique identifier assigned to a specific account within a financial institution. It distinguishes one account from another within the same bank or branch. Account numbers vary in length and format, depending on the bank or institution.

Account numbers are used to track and manage individual accounts. In financial transactions such as funds transfers, account numbers identify the specific account to which or from which funds should be transferred. While the routing number identifies the financial institution, the account number identifies the specific account within that institution. Financial transactions often require both numbers to transfer funds correctly.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.