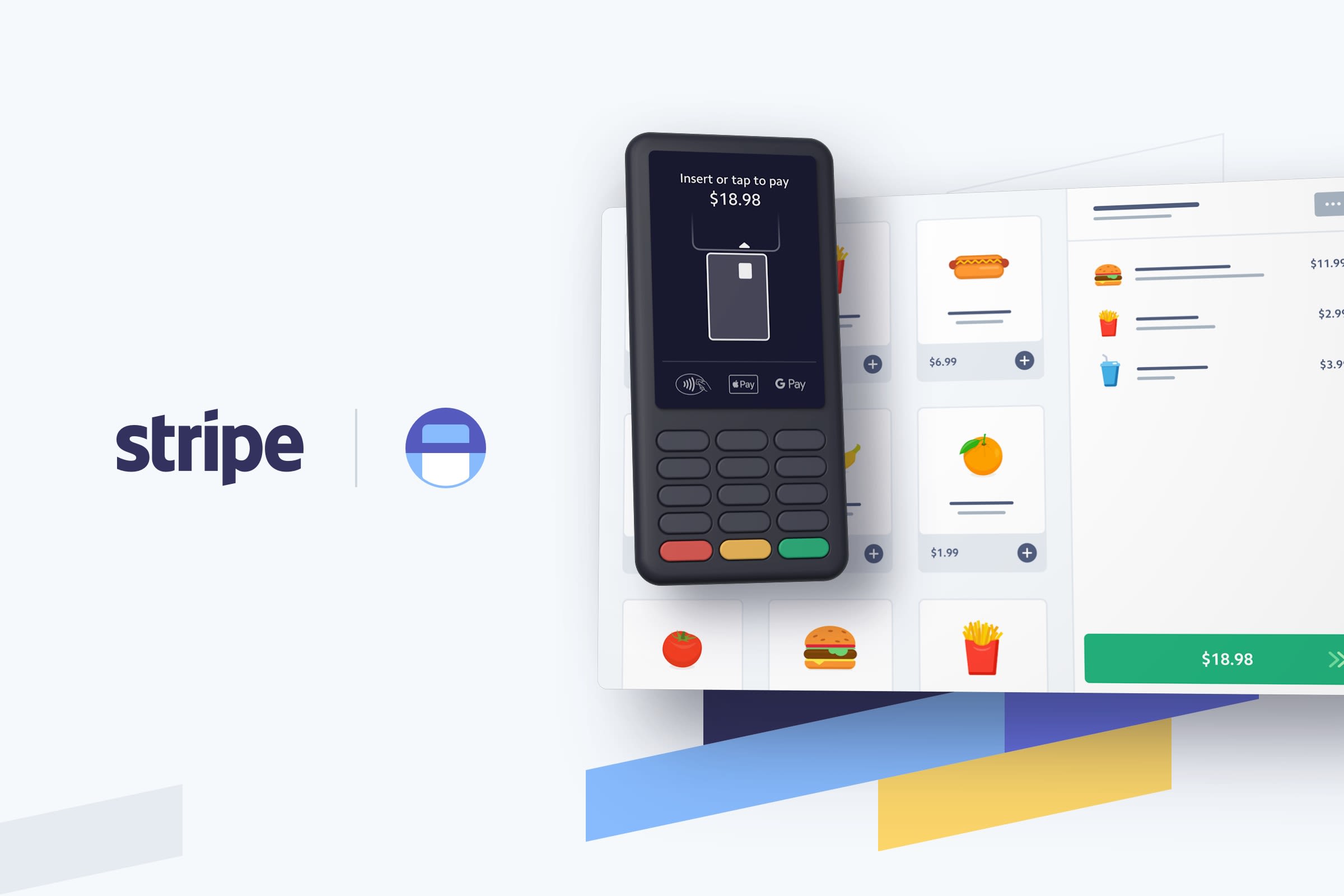

Stripe announces Stripe Terminal, a programmable point of sale for in-person payments

SAN FRANCISCO — Stripe today unveiled Stripe Terminal, a new product that extends Stripe’s infrastructure to the physical world. Stripe is known for powering internet companies including Postmates, Salesforce, and Zillow. Now, developers can build custom payments experiences for in-person transactions just as easily as they can for online purchases.

Stripe has expanded its product suite over the years to serve an increasingly wide swath of online business models. These now include on-demand companies, internet retailers, commerce platforms, recurring revenue businesses and, most recently, any company that needs to be able to issue its own credit cards.

Before Stripe Terminal, in order for internet-first companies to expand into the offline world and serve brick-and-mortar customers, they had to cobble together a mix of in-house teams and third-party providers, stitch together various point-of-sale hardware and point-of-sale software, manage burdensome security and EMV certification processes, and sort out the different regulatory and hardware requirements of every country where they hoped to add a storefront. Stripe Terminal will dramatically simplify this process and expedite international expansion, where myriad different local regulations, payment methods and hardware requirements can stymie global ambitions.

“Stripe Terminal will provide the same unified, global coverage for in-store payments as Stripe does for online payments,” said John Collison, cofounder and president of Stripe. “The question is: can we make the offline world as simple as the online world? As a software developer, you should be able to set up payments once, and have it work everywhere you need it to—on your website, in your app, in person, globally. With Stripe Terminal, we’re introducing just that: a way for internet-first retailers and SaaS companies to leapfrog the point of sale capabilities available to even today’s largest big-box retailers and to build a programmable payments experiences for in-store purchases that match what they’ve built online.”

Trendsetters in online-to-offline retail like Warby Parker and Glossier use Stripe to power transactions across both brick-and-mortar and browser storefronts alike, unifying their payments infrastructures. And, for the first time, Stripe Terminal offers an integrated payments solution for industry-specific booking and commerce platforms serving their own merchants: Mindbody (for yoga studios and fitness centers), Zenoti (for salons and spas), AtVenu (for concerts and performances), and Universe (for live events and tours).

Being fully integrated into Stripe’s product stack makes Stripe Terminal especially useful to companies running on Stripe today. “Because we already used Stripe for online payments, it was a natural extension for us to use Stripe Terminal for in-person payments as well. With other providers, getting a new merchant set up to accept payments through Zenoti can take anywhere from two to four weeks. With Stripe, a merchant can get up and running in literally a matter of seconds. For the spas we support, that difference can be a meaningful boost in their revenues,” said Vamshi Reddy, vice president of Product at Zenoti.

Stripe Terminal consists of three components:

1. A set of SDKs and APIs for creating a fully custom checkout experience using web or mobile apps

2. Card readers from Stripe’s hardware partners (BBPOS or Verifone), which are pre-certified to Stripe’s global processing platform, ready for “quick chip” EMV and contactless payments (such as Apple Pay or Google Pay) out of the box

3. Software for managing and monitoring connected devices across multiple locations or connected accounts—right from the Stripe dashboard

With these tools, businesses on Stripe can leapfrog the capabilities available to most large retailers today. For example, it’s notoriously difficult to update or customize software for in-store purchases. But with Stripe Terminal, businesses can customize every pixel of the checkout flow and push real-time updates (like different designs or location-specific promotions). Stripe’s cloud-based security architecture also minimizes PCI scope and offers end-to-end encryption that hardens defenses against hackers.

“Stripe Terminal offers a way for companies and platforms to unify commerce across online and in-store payments,” said Jordan McKee, research director at 451 Research. “Many of today’s in-store point-of-sale solutions create complex challenges for businesses, hampering their ability to experiment and grow. Stripe Terminal is designed to abstract those complexities, thus providing broad-based access to advanced features and customization options previously available only to large enterprises. Fully integrated with Stripe’s existing product suite, Stripe Terminal provides an onramp for multi-sided platforms, SaaS companies, and internet-first retailers to expand their digital commerce presence to the physical world.”

Pricing for Stripe Terminal includes a processing fee (2.7% + 5 cents) for each transaction. Card readers from Stripe’s hardware partners can be purchased today for prices that range between $59 for mobile readers and $299 for countertop smart terminals.

Stripe Terminal is available in the United States today, with more countries coming soon. To learn more, visit stripe.com/terminal.