Businesses of all types accelerate their growth with Stripe

Accenture on the future of payments and financial automation

AdaptedMind derives 5%–10% of revenue from recovered payments captured with Stripe

Fashion brand Adastria builds a new C2C platform using Stripe to ensure quick development of their payment function

Adore Me on embracing technology to create a seamless customer experience

Behind the scenes: How Aesthetic Record scaled to $1 billion in payments with Stripe

AFGE collects $7 million in monthly dues from 900 union chapters with Stripe Billing

Agua Bendita expands internationally with payment processing solutions from Stripe + VTEX partnership

Airpaz expands beyond Southeast Asia with Stripe

Danish startup Airwallet expands into 19 new territories with Stripe

Leading UK investment platform AJ Bell speeds up transactions with Stripe

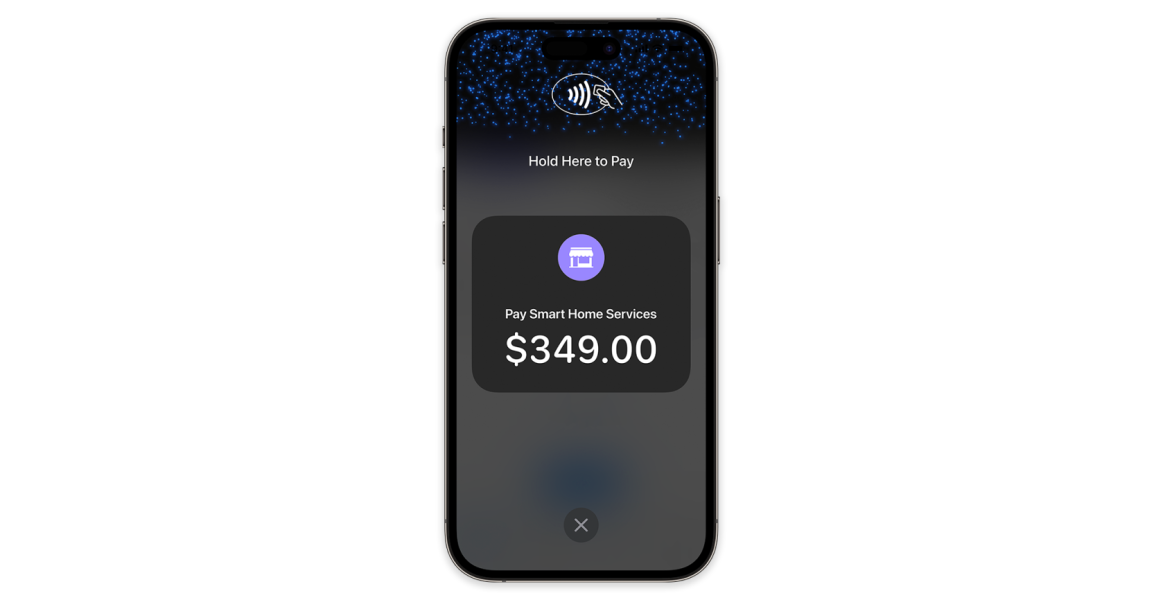

Alaska Airlines takes contactless payments to the skies with Tap to Pay on iPhone

Alberta Motor Association expands its membership model and enables future growth with Hiveway and Stripe

ALL CONNECT revolutionizes selling communications infrastructure online and accelerates launch with Stripe

Restaurant management platform allO adds quicker onboarding and next-day payouts with Stripe

18% YoY Donation Growth: The Strategy Behind AlloDons’ Fundraising Success

Alma optimizes performance through strategic Stripe partnership

Alternative Airlines becomes the first travel company to use Stripe's Issuing Travel BIN for its travel offering

Amazon simplifies cross-border payments with Stripe

AMP supports car washes with error-free subscription billing on Stripe

ANA Group turns to Stripe to build a next-generation mileage program

Ankorstore scales its B2B marketplace across 28 countries with Stripe

Behind the scenes: How Anthropic built a scalable revenue model with Stripe

APCOA partners with Stripe professional services for digital transformation

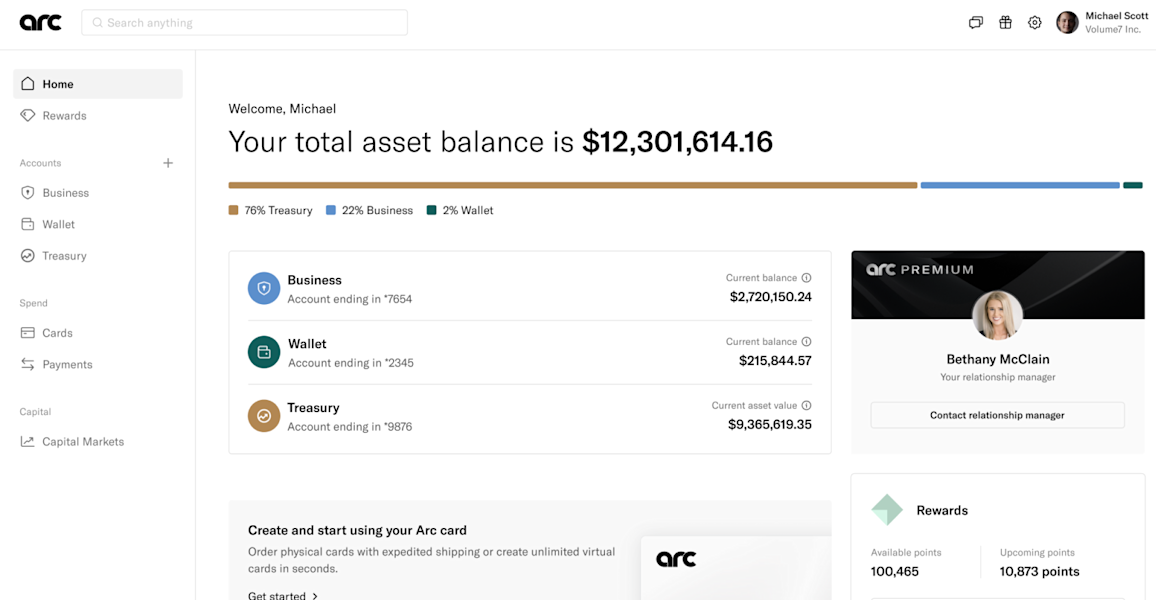

Arc builds the next generation of cash management with Stripe and Fifth Third Bank

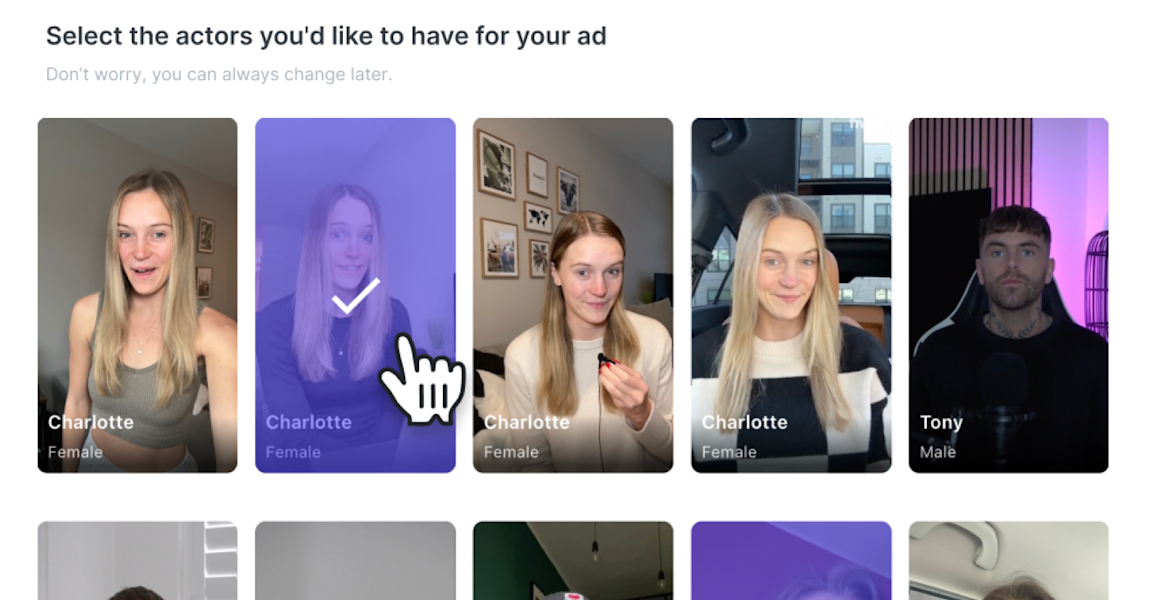

Arcads grows annual subscription revenue to $12 million in less than 2 years on Stripe

ARTERNAL on embedded finance tools for the art world

Artlogic empowers 5,000 art businesses with a cloud-based integrated payment solution

Astound on the evolution of ecommerce

Atlassian selects Stripe to create a single platform for global billing and payments

Atmoph opens a window to the world in 52 countries with Stripe

atVenu streamlines merchandise sales at live events with Stripe

Aureus Academy reduces finance admin time by 90% by managing payments with Stripe

Aurionpro Payments powers 97% faster business transactions across Asia with new payment platform

Avocadostore leverages Stripe’s flexible APIs to scale its eco marketplace

AWA partners with Stripe to simplify billing for its streaming music subscription

AWS on growing small businesses using the power of data

Barkibu increases revenue by more than 3,000% in 3 years with Stripe

Stripe Payments scales BASE FOOD to 90% year-over-year growth

Beautiful.ai grows revenue more than 40% with Stripe’s recurring billing tools

Beerwulf builds a global marketplace with Stripe’s comprehensive payments experience

Beerwulf on adapting to new payment methods to maintain customer loyalty

Ben & Frank boosts authorization rates in Mexico by 10% with Stripe

Beyond Menu transitions 100% of order volume to Stripe Connect in two months

BIG4 Parks combines 170-year heritage with Stripe technology nationwide

BigCommerce CEO Brent Bellm on what's next in ecommerce

Bikes Online achieves 10x growth in global expansion with Stripe

Blackthorn Payments and Stripe offer complete suite of payment solutions to Salesforce customers

Blaze reduces customer acquisition cost by 25% with Stripe Sigma and Stripe Data Pipeline

Blockchain.com partners with Stripe to bring more users to the crypto economy

Blockchain.com improves fraud detection at scale with Stripe

Bloomerang’s nonprofits increase year-over-year donations by 20% using Bloomerang Payments and Stripe

Bloomerang CEO Ross Hendrickson on software doing more good for nonprofits

Bloomerang allows nonprofits to accept more flexible donations without hardware using Tap to Pay on iPhone

BloomNation uses Stripe to help independent florists achieve 40% annual growth

Bodum expands globally by leveraging local payment methods with Stripe

Bond Vet generates $4.5 million from 15,000 recovered transactions with Stripe

Bookshop.org uses Stripe to help 2M+ customers support independent bookstores in the age of ecommerce

Booksy switches to Stripe for faster payouts and omnichannel payments

Online fundraising platform Booster onboards nearly 2,000 schools in three weeks after transition to Stripe Connect

Bounce helps travelers worldwide store luggage with Stripe Connect

Brightwheel grows from startup to vertical SaaS category leader with Stripe

How the British Council expanded its legacy services online with Stripe

Browserbase powers web browsing for AI agents and apps with Stripe’s usage-based billing

bsport doubles payment volume and goes global by catering to boutique fitness studios’ needs with Stripe

Buck Mason creates a powerful unified commerce retail platform with Stripe Terminal

buyolympia simplifies sales tax compliance in 11 states with Stripe Tax

ByteSIM reduces dispute rate to 0.02% with Stripe

Rungis and Califrais use Stripe Connect to launch a robust direct-to-consumer platform in 10 days

Canadian Red Cross increases recurring donor revenue by 24% with Stripe and Fundraise Up

Behind the scenes: Canva makes amazing design accessible worldwide with Stripe

CarbonPay launches carbon-offsetting cards with Stripe—in just 20 weeks

Carousell creates extensive fraud prevention process with Stripe

Castlery accepts in-person and online payments with Stripe, expands to the US

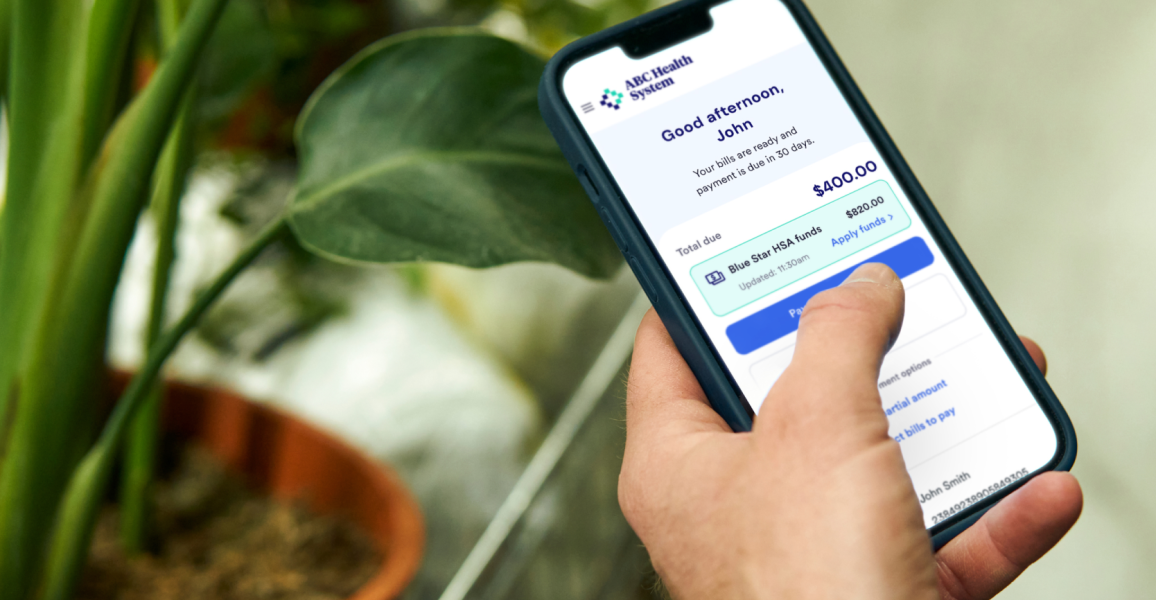

Cedar creates a simple and powerful financial experience for healthcare patients and providers using Stripe

Clip Studio Paint develops an error-free payment system for over 45 million customers worldwide with Stripe

Chargeflow saves 80 hours of work per month by automating usage-based billing with Stripe

Chartmetric achieves global tax compliance in 35 countries with Stripe Tax

Chatwork migrates to Stripe to increase customer value and drive business growth

Child Care Seer launches a complete management platform for child care providers in less than one year

Chow Sang Sang increased its payment conversion rate by 20% with Stripe

ChowNow uncovers new growth opportunities and payment insights with Stripe Data Pipeline

Ciklum on how seamless payment experiences can power customer loyalty

Classlist sees 124% revenue growth with adoption of Stripe

Classy Pay, powered by Stripe, creates best-in-class fundraising experiences for modern non-profits

Cleo reduces chargeback rate by 23% with Radar for Fraud Teams

ClickFunnels saves millions in development costs and launches new platforms with comprehensive Stripe integration

A.J. Axelrod from Clio on why SaaS platforms should focus on outcomes, not take rate

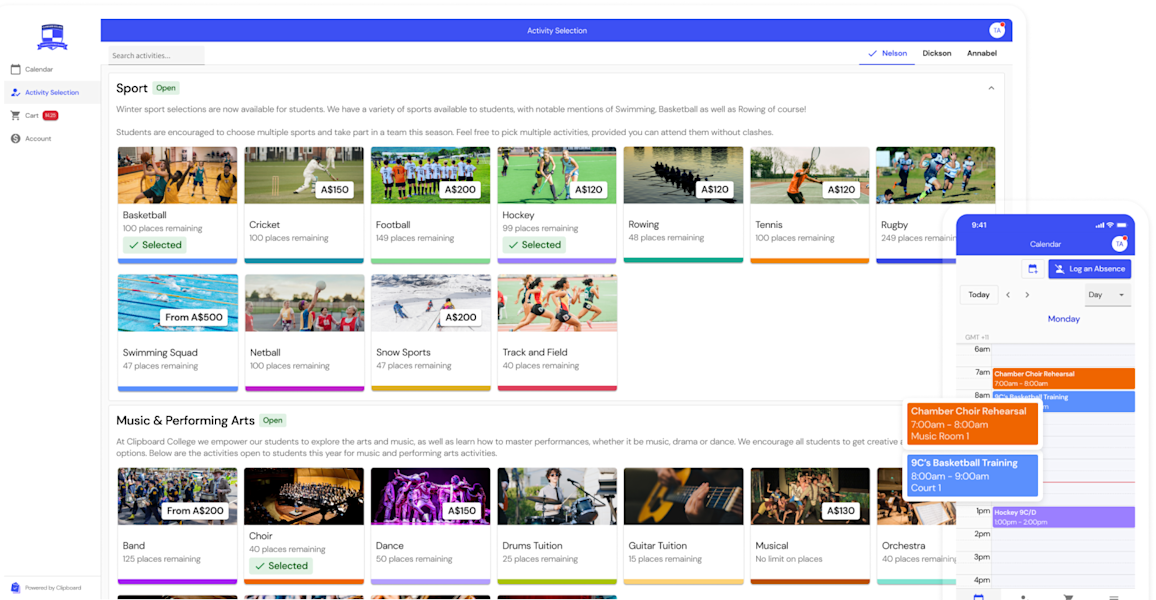

Clipboard enables digital student activity payments with Stripe Connect

Cloudbeds grows hospitality platform users’ revenue by 15% with Stripe

CNY Fertility generates $8.43M in revenue with custom payments platform by Echobind and Stripe

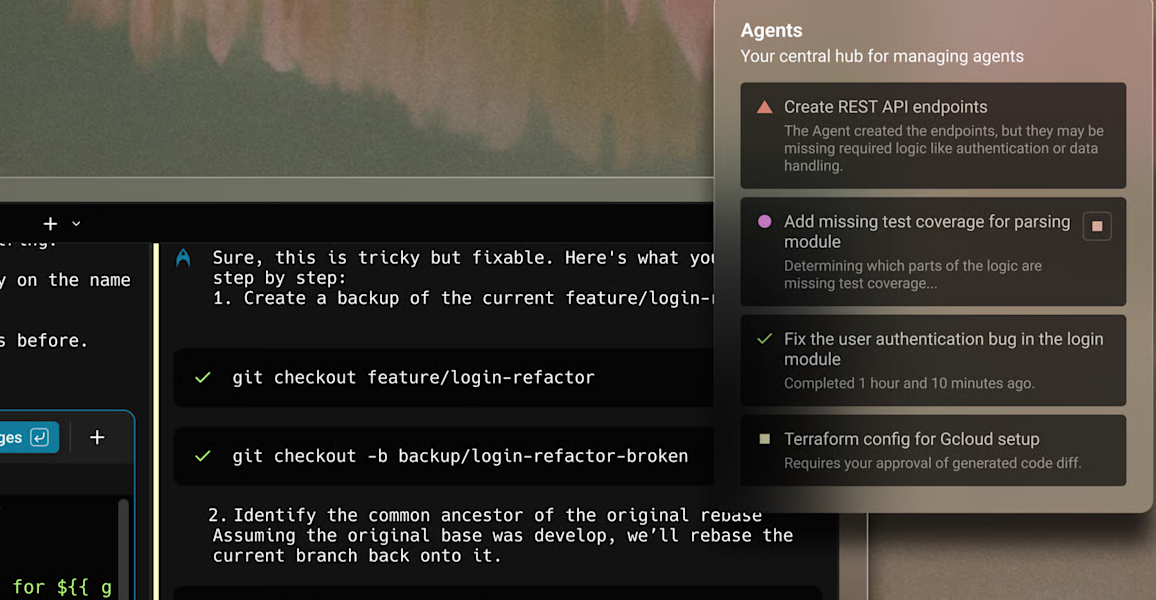

Cognition CEO Scott Wu on the evolution of AI coding agents and the future of software engineering

CoinPanel mitigates fraud and scales to 130K users in 6 months with Stripe

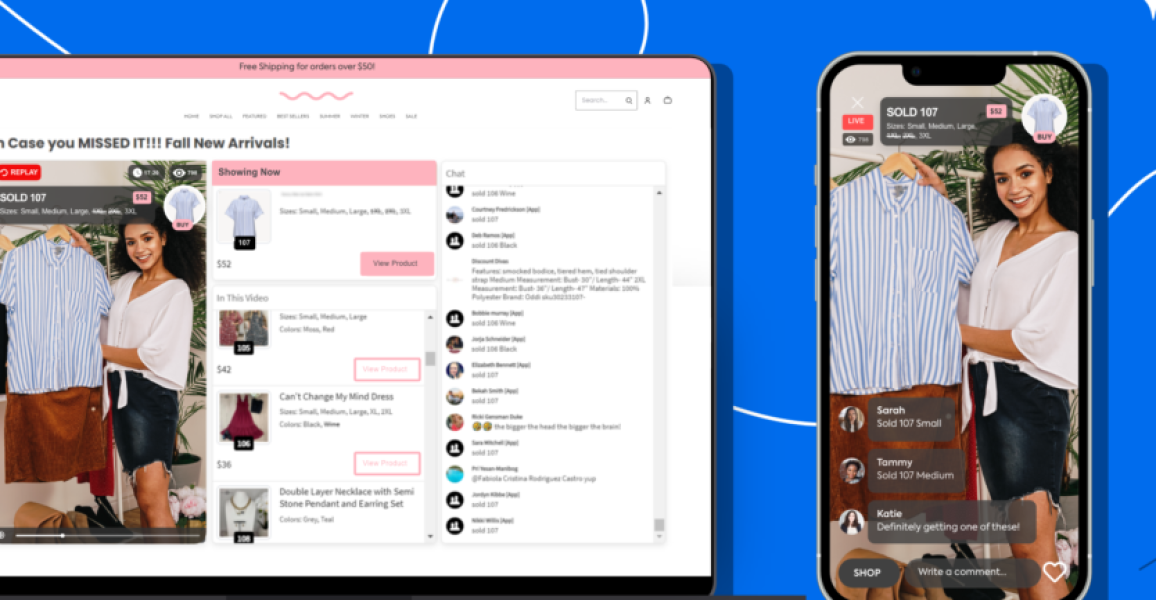

CommentSold on the growth and promise of live selling

Constanci on adapting pricing models to a changing marketplace

Crimson Education expands globally and streamlines customer experience with Stripe

CrowdFarming pays farmers 89% faster with Stripe

Mexican Red Cross partners with Stripe to power online and mobile payments

Crypto.com partners with Stripe to enable convenient crypto payments

CSFloat lowers crypto payment processing costs by 35% with Stripe

Cursor scales to billions in recurring revenue with Stripe

Dale Carnegie provides credit card processing in 24 countries and 16 currencies with Stripe

Decagon AI decreases costs for customer support operations by 65% after building Stripe-integrated AI agents

Decathlon partners with Stripe to support payments for 300+ new coaches and sports classes

Deliveroo expands globally and launches new revenue stream with Stripe

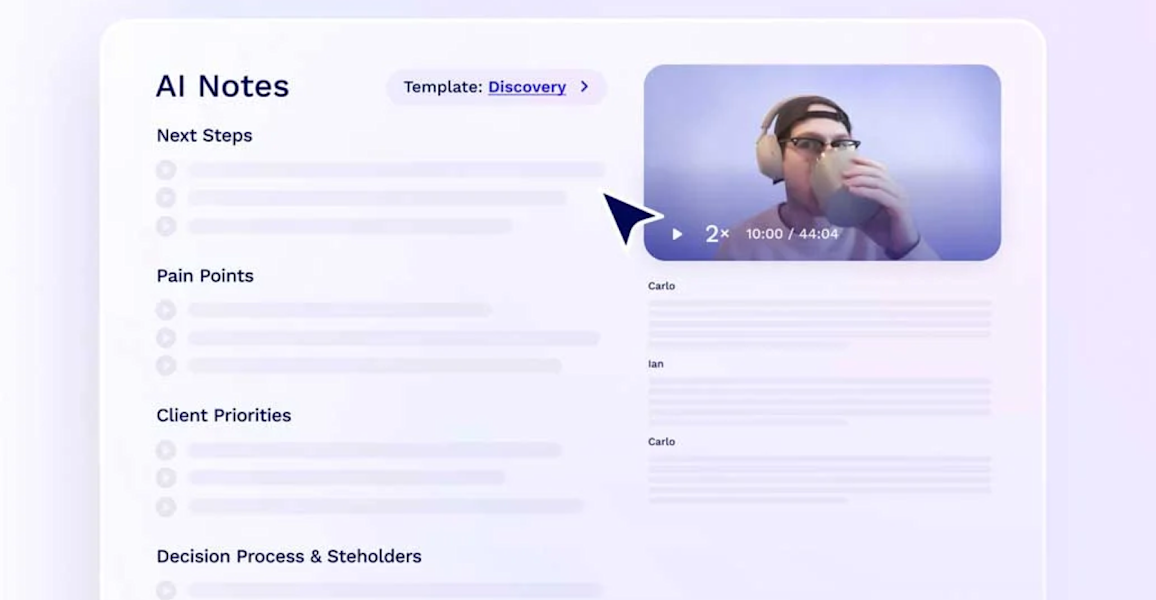

Demodesk accelerates month-end close with Stripe App Marketplace automation

Dermalogica reduces fraud rates by 50% with Stripe

Dines unlocks 150% jump in revenue per venue with Stripe Terminal

Donorbox processes over $1 billion in donations with Stripe

DonorsChoose uses Stripe to increase card acceptance rates by 17% and get more donations flowing to classrooms

DoorHub reimagines an industry ecommerce experience with payments powered by Stripe

DoorLoop reduces manual customer onboarding tasks by nearly 50% with Stripe

Dorsia pays restaurant partners 60% faster with Stripe Connect

Dreamship on eliminating barriers to creation for Vietnamese print-on-demand entrepreneurs

Dripos unifies commerce with Stripe Terminal and Stripe Reader S700

Dubsado expands payment options and develops a surcharging solution with Stripe and Redbridge

Dust uses Stripe’s MCP server to power AI agents with financial data in minutes

Dyn Media launches to millions of sports fans in one year with AWS and Stripe

Dyn Media works with Stripe professional services for smooth platform launch and growth

EaseMyTrip accelerates global expansion with Stripe

EasyParcel chooses Stripe for seamless integration and lower abandon rates

EatMe grows revenue 10x by delivering better value to diners and restaurants with Stripe

Edinburgh Airport boosts conversions by 3% with Stripe

eero launches new products in record time with Stripe Billing and Payments

Eight Sleep boosts conversions by 70% and cuts involuntary churn in half by switching to Stripe

Electrolux chooses Stripe to launch Levande subscription service in Singapore, in 45 days

Elevate Outdoor Collective integrates Stripe and NetSuite with a Nova Module engagement

Behind the scenes: How ElevenLabs grew into a $3 billion AI audio leader with Stripe

In-car video platform ember unlocks a new revenue stream with Stripe

Embrace Pet Insurance increases revenue and operational efficiency with Stripe Billing

Endava brings people together with technology

ePages partners with Stripe experts to consolidate and relaunch payments

Etsy partners with Stripe to offer Instant Bank Payments via Link

Eucalyptus expands its healthcare platform into Europe with Stripe

Eventgroove helps customers run climate-friendly events and fundraisers with Stripe

EventsAir launches embedded payments six months faster with Stripe professional services

Eviden uses Stripe to launch global subscription model for its real-time environmental scoring SaaS platform, EcoDesignCloud

Stripe helps Experienced Capital boost conversions for its digital brands

EZ-Charge makes charging a breeze for EV drivers with Stripe

Facile.it delivers a superior omnichannel payment experience with Stripe

FareHarbor tour operators streamline business by going cashless with Tap to Pay and Stripe Terminal

favy launches restaurant subscription tools in 3 months with Stripe

Félix powers $3 billion in payment volume through stablecoins and AI-driven remittances

Stripe helps felyx expand to 10 cities and save 2,000+ developer hours

Female Invest empowers women to subscribe to investment tools with support from Stripe

Fender migrates 70,000 subscribers in 3 hours using the Stripe Billing migration toolkit

FICO increases authorization rates by moving its myFICO consumer billing and payments to Stripe

Figma completes rollout of new billing model

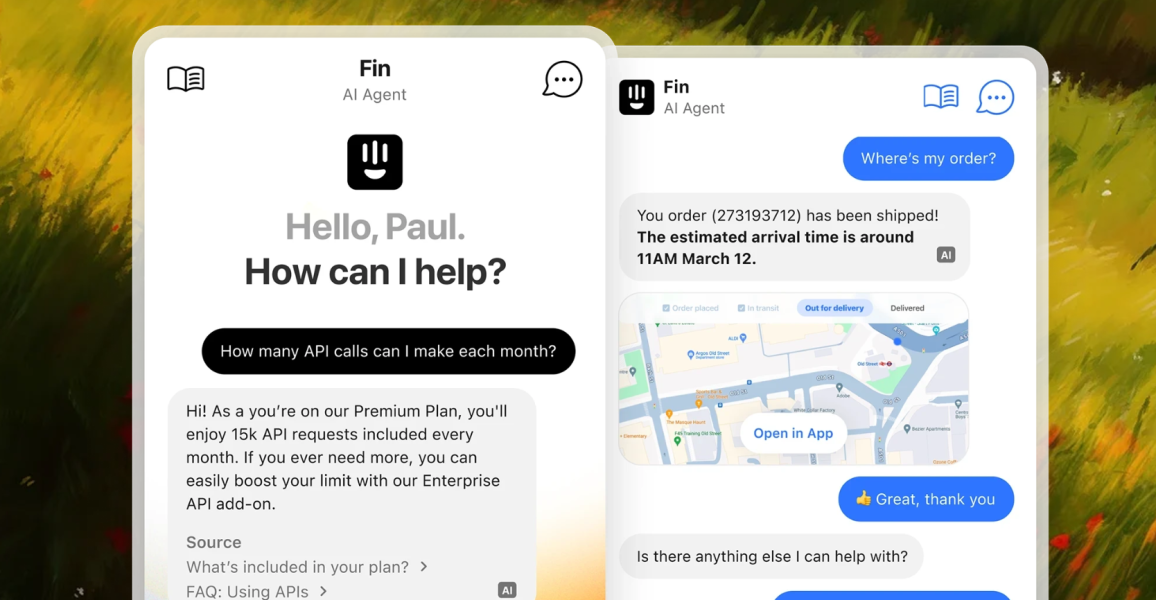

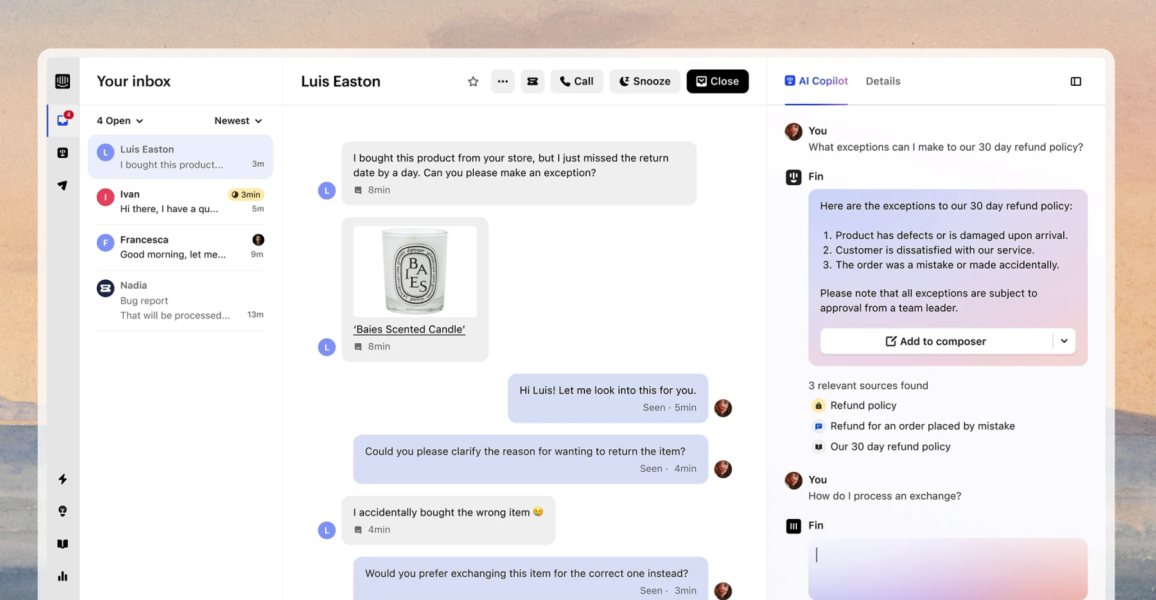

Intercom innovates outcome-based pricing for its Fin AI agent with Stripe

Findigs improves bank connectivity conversion by 14% with Stripe Financial Connections

Car subscription service FINN scales with Stripe to process $180 million per year

Flipdish achieves 97.42% acceptance rate during global expansion supported by Stripe

Flower Chimp boosts checkout conversion rate with Stripe

FOX Sports Mexico sees 20% uplift in subscription revenue with Stripe Billing

FREE NOW uses Stripe experts for its marketplace implementation

FreshBooks launches FreshBooks Payments, an embedded end-to-end payment solution, using Stripe Connect

Shirley Hsu from FreshBooks on balancing settlement speed with fraud risk

Frichti expands into corporate catering with in-person payments by Stripe

Frontdoor improves authorization and fraud rates with Stripe

Fundraise Up doubles online donation revenue for nonprofits with payment methods on Stripe

G Adventures launches a scalable, compliant payments platform with Constanci and Stripe

GAIA Design switches to Stripe and increases authorization rates by 9%

Gatwick Airport boosts payment acceptance rate with Salesforce Payments powered by Stripe

Getaround uses Stripe Connect to accelerate expansion across Europe

GitHub Sponsors expands international coverage by more than 5x with Stripe

GiveTap turns charity fundraisers’ phones into card readers with Stripe Terminal

Global SaaS platform transforms the world’s fitness industry with Stripe

GlossGenius helps beauty and wellness entrepreneurs grow their business with Stripe

Vertic helps Good Friday Appeal set a fundraising record by simplifying its solution stack and increasing flexibility for donors

Goodtill partners with Stripe to onboard 400+ new restaurants in under 4 weeks

Open Government Products on solving the Singapore public sector’s biggest challenges through the power of technology

Green Flag adopts modern payment system, gains powerful data insight with Stripe

GroundScope cuts compliance costs by 50% with Stripe

GroupGreeting increases conversion by 8% using Stripe Checkout

Grubhub partners with Stripe to offer Cash App Pay

GuruHotel grows payment volume 128% and helps hotels book international travelers with Stripe

Halara partners with Stripe to drive global growth through payment innovation

Handyhand increases revenue by 500% using Stripe Connect

Global gym management platform Hapana scales to processing $300 million AUD in payments annually with Stripe

Hargreaves Lansdown reduces failed payments by £540m in partnership with Stripe

Heidi achieves 15x year-on-year growth with Stripe

HelloAsso achieves 94% acceptance rate and transforms France's nonprofit sector with Stripe

Hero Health gets UK general practitioners paid faster with Stripe Invoicing

Hertz unifies commerce with Stripe

Hex meets users’ rising compute demand with usage-based billing powered by Stripe

HeyCentric makes citizen payments to public institutions easier, with Stripe

HeyGen reduces fraud and boosts auth rates by 21% with Stripe professional services

Higgsfield AI exceeds $200M run rate in 9 months since launching on Stripe

HitPaw sees 1.8x revenue growth with Stripe

HitPay empowers SMBs with unified payment solutions using Stripe

Hoalen unifies online and in-store payments with Stripe

HoneyBook processes $8.4 billion in payments with Stripe

Housecall Pro grows into a complete fintech platform using Stripe

Houzer launches ecommerce site in eight weeks with BigCommerce and Stripe

HubSpot develops flexible invoicing and payment tool powered by Stripe

Huntr doubles subscription revenue four years in a row using Stripe

IBM Consulting on how global industries must adapt in the face of digital transformation

ICE InsureTech on renovating the insurance tech industry

Ignition creates first-of-its-kind commerce platform for service businesses worldwide

INDOCHINO increases conversions by offering a new way to pay with Klarna via Stripe

Behind the scenes: How INDY powers the future of independent movie theaters with Stripe

INFORICH reduces payment failures by 20% and expands globally with Stripe

Ingka Centres on building an automated coworking space

Inland Group drives cross-border efficiency and scalability with Stripe payment solutions

Inn Style partners with Stripe for increased payments reliability and 57% faster payouts

Behind the scenes: How Instacart powers online grocery delivery with Stripe

Asha Sharma, COO of Instacart, on building technology to power the grocery industry

Intelsat switches to Stripe to power payments for in-flight Wi-Fi

Inter.mx partners with Stripe to launch freemium insurance model in Mexico

Intercom supports new AI products and subscription pricing models with Stripe

Behind the scenes: How Intercom launched flexible subscription pricing and improved customer experience by migrating its billing platform to Stripe

Intercom on the evolution of value-based pricing for AI agents like Fin

Invideo boosts renewal recovery by 30% and new revenue by $1M with Stripe

As it looks to expand globally, IRIAM adopts Stripe for web payments to better target different consumers’ payment needs

The city of Ishikari provides a new on-demand public transportation service with Stripe

Italic brings the luxury of one-click checkouts to its customer experience with Stripe

Italic on luxury goods without the markup

Jane on providing frictionless solutions for healthcare practitioners

96% reduction in Jenni’s dispute activity with Chargeblast Stripe app

Jobber expands its platform with new financial service products, Stripe Capital and Instant Payouts

Jobber and Stripe help 200K+ home service professionals save on payment fees

Jotform grows 6x by turning forms into payment-powered workflows with Stripe

Journey’s hospitality performance platform grows revenue 40% YoY, powered by Stripe

Kahunas decreases customer churn by 9% with Stripe Billing

Kajabi unveils Kajabi Payments, powered by Stripe, and drives success for 60K+ creators

Kajabi quickly launches accounting integrations with Stripe Connect embedded components for Apps

Karat builds a new financial product for creators in just three weeks using Stripe Issuing

Karta consumer marketplace nearly eliminates fraud risk with Stripe experts

Cold Fusion helps Kashika optimize payments to enable faster growth

With Stripe, Keap helps small business owners grow with a unified payments and tax compliance solution

KeyMe disrupts the locksmith industry with Stripe

Kickstarter extends its global reach and continues to enhance the crowdfunding experience with Stripe

KINTO uses PayPack to save its team 6+ hours per day by connecting Stripe to NetSuite

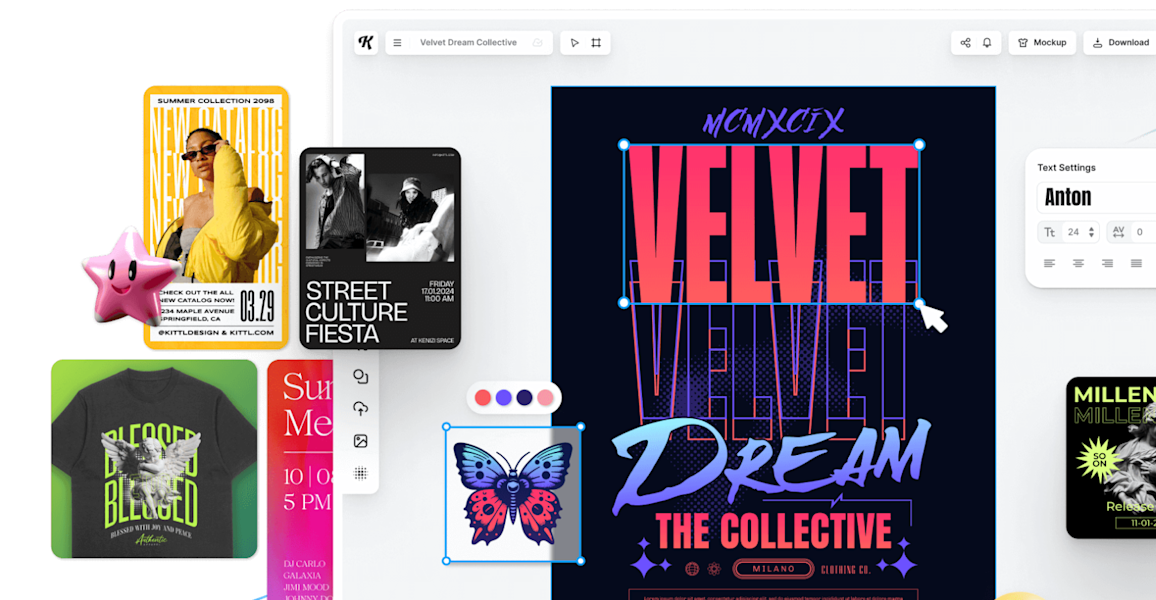

Kittl lifts payment success rate by 2.12% and reduces churn with Stripe

Klarna and Stripe team up to offer flexible payments and seamless processing globally

How businesses are driving growth across industries with Stripe and Klarna

Raji Behal from Klarna on how consumer preference shapes payment strategy

KRY partners with Stripe for frictionless expansion and enhanced patient experience

Minna no Market partners with Stripe to integrate card payments for its online marketplace

Kwik Fit introduces a new subscription-based offering and gains a first-mover advantage in the UK market

La Redoute replaces legacy systems with Stripe to offer world-class customer experience

Landing streamlines payments with Stripe to expand to over 200 cities

Langfuse scales cloud billing with Stripe while metering billions of events

LaunchDarkly uses Stripe Climate to put every donated dollar to work fighting climate change

Le Monde chooses Stripe to improve local and international payments

LeasePlan saves €35K–€40K a year by automating service-delivery processes with Stripe

Leonardo AI scales rapidly with Stripe’s billing, payments, and fraud solutions

LetsGetChecked sees 5X ROI from Stripe Radar for fraud detection

LG Electronics Japan enlists Stripe to combat fraud and boost payment success rates

Lightspeed drives more revenue as a modern payfac with Stripe

Lightspeed partners with Stripe to accelerate innovation in omnichannel payments and more

Lime improves accuracy and speed of financial reconciliation with Stripe Data Pipeline

Linear partners with Stripe to handle billing and payments as it grows

LiveX AI powers 200% improvement in customer retention through AI agents integrated with Stripe

Local Vacation Rentals increases owner revenue by 20% with Foxbox and Stripe

Lookiero scales a complex business model with Stripe's simplified payments

Lopay enables its users to keep more of their profits with Stripe Issuing

Lopay helps its users increase sales with Tap to Pay on iPhone

Visa and Stripe help Lopay’s users increase sales with Tap to Pay

Lottus Education partners with Stripe to implement a fully compliant payments solution in two weeks

Riding the AI boom: How Lovable grew into a vibe-coding juggernaut with Stripe

LTK cofounder Amber Venz Box on forging economic success for creators and brands

Luckin Coffee partners with Stripe to go global faster, enabling a seamless customer experience

Lugg partners with Stripe to streamline worker onboarding and offer instant payouts

Luxury Escapes blocks $200K in fraud in 30 days with Stripe

Lyft optimizes the driver and passenger experience with Stripe

Lynk & Co partners with Stripe experts to create a hassle-free payment experience

Lyra Health scales with Stripe, easily handling 200% growth in payment transactions

Lyte expands in-person payments to UK, forecasting 2.5x growth by end of 2022

Stripe helps M3 Education improve operational efficiency and convenience for users

Magic Eden expands access to the Web3 economy with Stripe’s crypto onramp

MagicSchool launches new freemium model that drives revenue growth using Stripe

Make recovers $1.2 million in revenue with Stripe authorization and recovery tools

Mamo chooses Stripe to offer secure, easy payments in UAE

Mangomint reduces onboarding time by 64% with Stripe

Manus uses Stripe to rapidly monetize its viral AI product

Margin scales payment volume 5x in 10 months

me&u turns to Stripe for speed and scalability as it expands internationally

me&u boosts incremental sales growth for its venues by 60% with Tap to Pay on iPhone

Meetup increased trial conversions by 3x with Stripe Billing

MemberPress uses Link to reduce friction at checkout for US and EU merchants

Mercury streamlines collections with Stripe-powered invoicing solution

Behind the scenes: How Mindbody built its integrated payments platform with Stripe

Mindvalley supports 40% growth and $150M in revenue with Stripe Billing

Minelab unlocks a new customer base by enabling cross-border payments between Indonesia and Malaysia

MiniMax monetizes its latest AI product using Stripe

Mint Payments uses Stripe to process $3 billion in travel industry transactions

Mixtiles grows from a startup to an international phenomenon while optimizing with Stripe

Monzo expands its financial tools for businesses with Tap to Pay on iPhone

Moon Holidays scales revenue 6x with Stripe

Moonbeam on using AI to automate the writing process

MoonClerk offers a robust payments platform and reduces customer churn by over 30% with Stripe

Morisawa Inc. shortens lead times and improves in-house development capabilities with Stripe

Motion accelerates from startup to hyper-growth with Stripe

Mountain Warehouse switches to Stripe to power reliable online payments with 99.99% uptime

Myers-Holum on powering payments and financial infrastructure for enterprises

MyKaarma sees 180% YoY growth after modernizing auto payments with Stripe

MYOB launches B2B payments in a new country in weeks using Stripe Connect

mySofie streamlines healthcare payments and onboards users in less than two minutes with Stripe

N26 partners with Stripe to make bank account top-ups instant for over 7 million clients

Nasdaq chooses Stripe for robust security and scalability

Navan uses Stripe Issuing to grow its payments and expense solution 5x

Neuron Mobility teams up with Stripe professional services to reduce market entry and expansion costs

Sessions Insights: How NewStore and Stripe are simplifying retail management

Patient experience platform NexHealth achieves record payments volume with Stripe Connect

Nextech launches secure healthcare payments platform with Stripe

Nextech turns to Stripe to power in-person payments across client networks

Nikkei chooses Stripe to improve access to its fast-growing digital platform

Noleggiare builds a unified payment and reporting experience with Stripe

Noom increases global authorization rates by more than 8% with Stripe

Nord Security uses Stripe enterprise services to drive payment optimization

Oasis Hotels reduces fraud by 90% and modernizes payments with Stripe

Octopus Energy on investing in renewable energy to tackle the energy crisis

Oddle uses Tap to Pay on Android and SUNMI to provide diners a simple payment experience

OfficeRnD Streamlines Payments for Global Coworking Spaces with Stripe

Oh my teeth integrates cashless payments in one week, with Stripe

Ohio Power Tool speeds up transaction times by 50% with Stripe Terminal and Nova Module

Omnyfy enables the global shift to multivendor commerce through an evolving marketplace model

Onespot helps schools integrate payment data with Stripe and an embedded app for QuickBooks

Open Infra cuts invoicing time from weeks to seconds with Stripe Billing and Zapier

Sam Altman and John Collison’s fireside chat at Stripe Sessions

Opus CEO on empowering clients through constant execution

OrderMyGear modernizes its checkout flow and increases average order volume 67% with Stripe

OrderUp on empowering seamless restaurant checkout experiences

Orix relies on Stripe to launch PATPOST, its electronic business document storage service

Outseta selects Stripe Tax over merchant of record to manage global tax compliance

OYO expands into new markets and delivers an improved operator experience with Stripe

Pai on reducing subscription churn for businesses

Papier moves to Stripe for revenue uplift and cleaner customer journeys

Park.Aero Improves Payment Success Rate by 7.3% After Switching to Stripe

Passenger powers its platform payments with Stripe, generating 170% growth

PatPat and Stripe increase bank authorization rates and create a new global payment experience

PayFunnels powers global solopreneurs with Stripe Elements and the Checkout Sessions API

Mobile app Payment partners with Stripe to support more than 153K users with no-code solutions

Payment Plugins offers WooCommerce merchants over 27 payment methods with Stripe

Behind the scenes: PepsiCo chooses Stripe to power flexible ecommerce and in-person payments

Perfect Tux achieved its best performing quarter with funding from Stripe Capital

PGA leads digital transformation with Stripe

Phil Pallen Collective automates payment processes with Xero and Stripe to serve 360+ global clients

Philo scales its subscription business with Stripe Billing

Phorest boosts payments revenue 335% after unifying online and in-person payments with Stripe

Pitch rolls out new presentation software globally with Stripe

Planity grows payment volume by 200% and launches new revenue stream with Stripe

Behind the scenes: How Planning Center grew to process $600 million in monthly donations with Stripe

Playtomic grows to one million monthly active users worldwide with Stripe

Pluralsight achieves global technology learning with Stripe Payments

Podium enables $3M in payments to local businesses with Stripe & Affirm

Podium gives local businesses more flexibility with Tap to Pay on iPhone

Polygon.io syncs seven years of data in two weeks with Stripe for Salesforce Platform

Stripe helps PopChill create a safe, efficient, and low-carbon ecosystem for second-hand luxury goods

Postmates boosts authorization rates with Stripe, adding $70+ million in revenue

Postmates saves more than $3 million in card network fees with Stripe’s payment consultation services

POWR enables small businesses to sell globally with Stripe

Presbyterian Ladies' College, Sydney reduced financial reconciliation time by 80% with modern payments system

PushPress expands to serve 5,000+ gyms by integrating payments with gym management software via Stripe

QikServe launches scalable, global payments platform with Stripe

Raisely helps more than 2,000 nonprofits and charities raise $500M with Stripe

Behind the scenes: How Ramp built a global corporate card program with Stripe

Ray studios solves local regulation payment issue with Stripe

Re-Leased uses Stripe to help digitise $15bn of rent collection

Reach simplifies global expansion with merchant of record solutions powered by Stripe

RefQuest (RQ+) streamlines financial processes with Stripe to enable growth

refurbed boosts conversion rates with one-click payments via Stripe and Klarna

reMarkable minimises fraud to 0.10% with the strength of Stripe’s fraud intelligence

Rental Car Manager implements omnichannel payments for vehicle rental companies in less than three weeks

ResNexus expands to new markets with white-labeled payments platform built on Stripe

Retell AI automates usage-based pricing to scale its AI voice agent platform with Stripe

Retool recovers over $600,000 with Stripe revenue suite

Rezdy powers payments for more than 17,000 tour operators globally with Stripe

River Island improves authorisation rates by 3% with Stripe’s unified commerce solutions and Cabiri

Rohan attracts 6.5% more online shoppers within two months of integrating BigCommerce and Stripe

Roomex doubles usage of its expense card solution after switching to Stripe

Runway protects developer time with no-code solutions from Stripe

RushOrderTees boosts conversion rate 3.50% with Stripe’s Optimized Checkout Suite

RVshare partners with Stripe for 100% payments reliability with 3x bookings

Salesforce teams up with Stripe to power seamless commerce experiences

Michael Affronti of Salesforce on how commerce is accelerating to the cloud

SamCart boosts average order value by 60% with Stripe

Samsonite improves customer experience and payment success rate with Stripe

Scholastic Australia enables fast purchases with Tap to Pay on iPhone

SeatGeek fuels growth of fan-to-fan ticket marketplace with Stripe Connect

Semble selects Stripe to merge healthcare SaaS with payment solutions

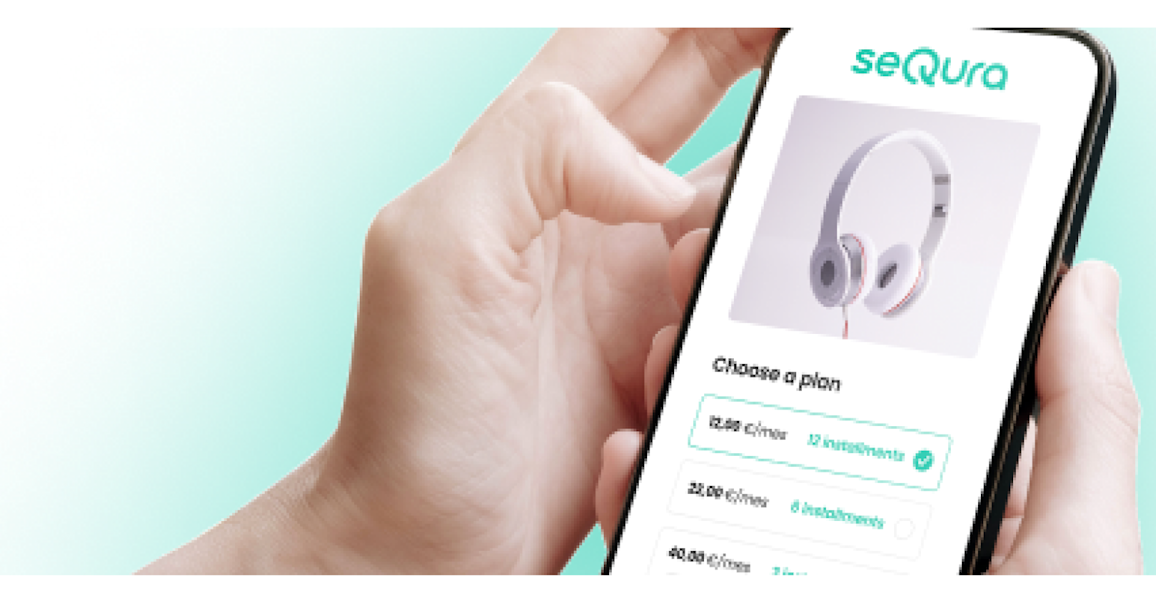

SeQura, a BNPL, sees 55% revenue growth after partnering with Stripe

ServiceM8 brings contactless payments to the jobsite with Tap to Pay on iPhone

Shadeform boosts revenue 10% by accepting stablecoin payments through Stripe

SHARE NOW chooses Stripe as a reliable partner for smooth payment processing

Sharetribe uses Stripe to deliver solutions to complex marketplace needs

Shift accelerates European expansion and streamlines payments with Stripe

Shipt automates revenue recognition and financial reporting with Stripe

Shopcada chooses Stripe to accelerate growth

Shopify builds Shopify Balance with Stripe to give small businesses an easier way to manage money

Shopify uses Tap to Pay on iPhone to give merchants the accessibility and convenience of accepting in-person payments with just an iPhone

Shoplazza uses Stripe to power global growth with seamless cross-border payments

Shopmonkey provides auto repair shops with access to millions in loans with Stripe

Shore partners with Stripe professional services for Shore Pay Terminal rollout

Shotgun drives over 560% rise in payment volume with Stripe Connect

Shueisha builds a new platform for global manga art fans, supported by Stripe

Simon Cabaret increases authorization rate by 24% with Stripe

SimplePractice launches automatic payments offering for clinicians with Stripe

SiteMinder expands to serve hotels in 150 countries with the help of Stripe

Skip increases checkout conversion and launches new instant payout feature with Stripe

Slack uses Stripe to process payments and achieve 99% authorization rate

SnowCloud blocks $3.2M in fraud and transforms resort and amusement operations with Stripe

Snowflake on the advantages of consumption-based pricing

Snowflake partners with Stripe experts to launch a marketplace in four months

sofatutor deploys Stripe Billing to launch new subscription learning offering

Sonar propels subscription business and data insights with Stripe

Founder sets up Stripe in two days with simple implementation

Sonic Automotive transforms the online car buying experience with Stripe

SourceNext works with Stripe to combat credit card fraud

Spades reinvents the dine-in checkout experience, with payments powered by Stripe

SplitIt scales global growth with Stripe

Splunk scales operations with a unified payment solution from Stripe

Spond Achieves 40% Annual Payment Growth Across 19 Countries with Stripe

Sports Warehouse uses Stripe to centralize global payments across 12 brands

Squarespace allows users to ‘own a piece of the internet’

Squire uses Tap to Pay so barbers can start accepting in-person payments in minutes

Stand Up To Cancer achieved a 30% increase in recurring donors by using Stripe

Staycity unifies guests’ payment experience with Stripe and Oracle OPERA Cloud

StoneLoads modernizes product purchasing for the natural stone industry

StyleSeat partners with Stripe to double revenue for beauty professionals

Substack surpasses five million paid subscriptions with Stripe

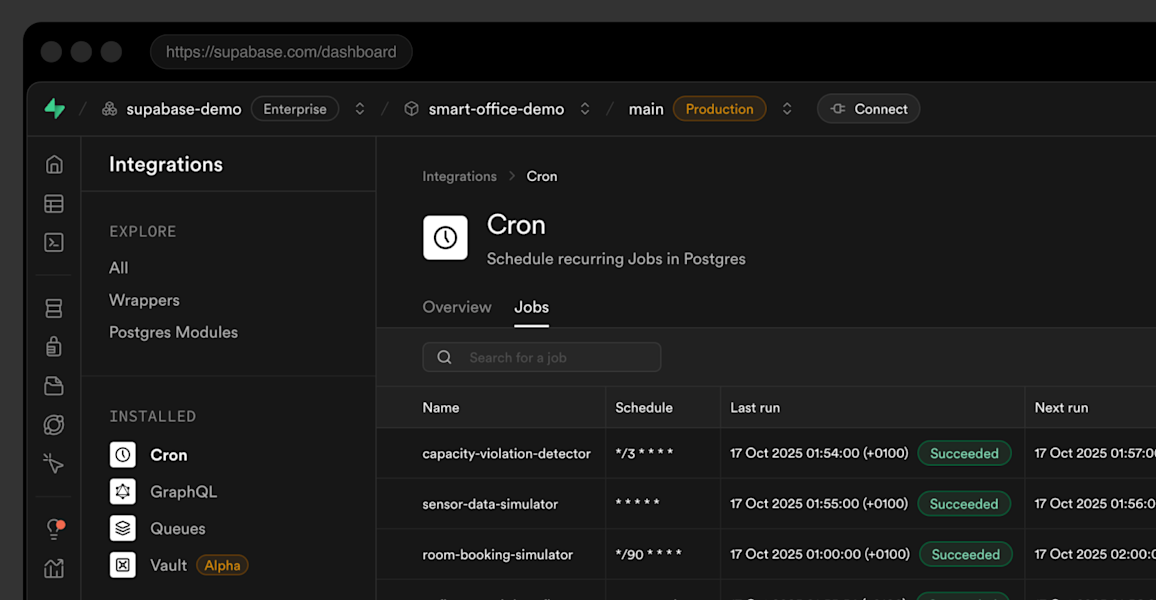

Supabase delivers its backend-as-a-service to 150 countries with Stripe

Susquehanna Growth Equity partners with Stripe to build payment capabilities in portfolio companies

Swimming Australia creates a single payments platform for nearly 1,000 organizations with Stripe

Taboola enables advertisers to reach 600M daily active users with Stripe Payments

TADA accelerates global growth with Stripe Payments

Tango partners with Stripe to unlock sales-led strategies to serve enterprise customers

Tango on building the business software for the hospitality industry

Taqtile uses Zaybra to integrate Stripe payments with HubSpot in one hour

Targeted Victory uses Stripe Connect to power campaign donations across the United States

Teachable helps creators earn billions with Stripe

TeamSport Achieves a 2.6 - 4.7% Increase in Progression Rate with Stripe

Tekion sees 90% of customers adopt its Stripe-powered embedded payments solution

Enhancing auto shop success: Tekmetric integrates Stripe for seamless customer experience

TENTIAL achieves a 98% payment success rate and enhanced anti-fraud measures by integrating Stripe into its ecommerce platform

tete marche expanded its Instagram analytics subscription service with Stripe Billing

TF1 launches France’s first streaming platform, with a paid option using Stripe technology

The Giving Movement boosts conversion by 25% and expands globally with Stripe

theCut uses Stripe to build its end-to-end payments experiences

Thinkific partners with Stripe to boost creator revenue and simplify back-office operations

Thinkific on creating a platform for creator educators to build businesses

ThinkReservations uses Stripe to enable faster, more secure onboarding for hotel operators

Thoughtworks on creating extraordinary impact through technology and cultural excellence

ThriveCart helps 75,000 creators boost revenue worldwide with ThriveCart Pro+ powered by Stripe

How Ticket Tailor uses Stripe to expand globally with minimal effort

TicketSocket increases conversion rates by 10% with Link

Tiller sees 90% increase in trial sign-ups with Stripe Checkout

TixTrack provides access to more experiences globally by reducing reporting time, with Stripe

tl;dv Grows Revenue by 600% with Stripe

Togetherwork partners with Stripe experts to build a seamless experience for its customers

Togetherwork saves 40 hours of work per month with Stripe to focus on financial analysis and strategy instead of data management

Tokyo Otaku Mode uses Stripe to power payments for its Japanese pop culture ecommerce platform

Tokyu Corporation improves operational efficiency and conversion by 20% with Stripe

Torrens University modernizes the payment experience for 19K+ students with Stripe

Toyota chooses Stripe to create sustainability-driven platform for buying and selling equipment

Trade Tested boosts sales 1.5% and reduces fraud by 50% with Stripe

Travello boosts cart size by 4% and reduces fraud by 16% with Stripe

TravelPerk COO Huw Slater on how to emerge stronger from a crisis

Traxero partners with Stripe to launch its unified commerce solution in four weeks

Tuple on how pair programming can make people feel less lonely

Turo reduces costs and boosts revenue by consolidating pay-ins and payouts on Stripe

TV 2 uses Stripe to build flexible subscription billing platform

Twilio increases its authorization rates by 10% with Stripe

Twilio on building a global customer engagement platform

Typeform powers its subscriptions globally with Stripe

Ubsidi helps restaurants improve cash management with embedded finance tools from Stripe

Unanet uses Stripe Connect to streamline payments for B2B customers

Undetectable AI sees 48% increase in gross profit since adopting Stripe

Ungerboeck on powering the post-pandemic return of live events

Universe owns the offline and online customer experience with Stripe Terminal

Unobravo quickly expands into two new markets with Stripe Connect

UNTOLD Dubai Launches International Ticket Sales in Days with Stripe

Uplisting generates $700k in referral sales using Stripe Apps

Urbankissed grows its online marketplace by 150% with Stripe

URBN consolidates $5 billion in online and in-store revenue onto Stripe

VEED recovers $1.8 million in payments in 1 year with Stripe’s Smart Retries

Vibefam grows embedded payments to 10% of revenue with Stripe

Videopro frees up cash flow and optimizes checkout with Stripe

Visualsoft’s payments platform built with Stripe drives 35% lift in conversion

It pays to talk with conversational commerce

Voodoo partners with Stripe in the US to offer streamlined in-app purchases

Vyro uses Stripe to power global expansion of its AI-powered SaaS platform

Warp grows usage-based AI billing to 20% of revenue with Stripe

Wayflyer implements Stripe Issuing to unlock over $700M in funding for growing ecommerce startups

Weave uses Stripe to launch new payments platform for SMBs

Whimsical uses Stripe Climate to make every dollar count in its commitment to climate change

Whoppah grows triple digits year-over-year with Stripe

Wiley streamlines its payment operations with Stripe

Withlocals on connecting travelers and locals through shared cultural experiences

Wix on helping businesses live their best digital lives

Wix payments grows EMEA coverage in collaboration with Stripe

Wonderbly chooses Stripe Checkout to maximize efficiency and conversion

WooCommerce partners with Stripe to launch in 17 new countries in 3 months

WooCommerce Payments GM on giving businesses “unlimited flexibility” to thrive

Woo lowers the barrier to entry for in-person payments using Tap to Pay on iPhone

WordPress.com uses Stripe to power recurring payments for millions of websites

Wordtune wins 5.4x more chargebacks with the Chargeflow Stripe app

World History Encyclopedia increases conversion rates by 5% with Checkout

Xero helps customers speed up the cash flow cycle with Stripe

Xero and Stripe make it easier for small businesses to get paid with Tap to Pay on iPhone

YAMAP streamlines payments across business lines by using Stripe

Yohana provides next generation family concierge services with Stripe

Yoycol improves fraud prevention, reducing false positive and dispute rates to less than 0.2%

Zapier sees 4% uplift in auth rates with Stripe, creating $3M+ in additional revenue

Zeffy scales donation volume 30x with Stripe, processing $1B+ for nonprofits

Zendesk enters new markets and reduces costs by $1.5M annually with Stripe

Zoom accesses global payment methods and reduces churn with Stripe