A subscription management tool that moves as fast as you do

Manage subscriptions, reduce churn, and grow revenue – all with less engineering effort. Stripe Billing is the subscription management tool built for scale, flexibility, and global reach.

Subscription tools

Finally, a better way to manage subscriptions

If you're launching a new product, scaling across regions, or looking to reduce churn, your subscription management software should work as hard as you do – without adding more friction to your workflow or errors to your reporting. Stripe helps you manage the full subscription lifecycle, with tools that make recurring billing both reliable and adaptive.

Launch new pricing models fast

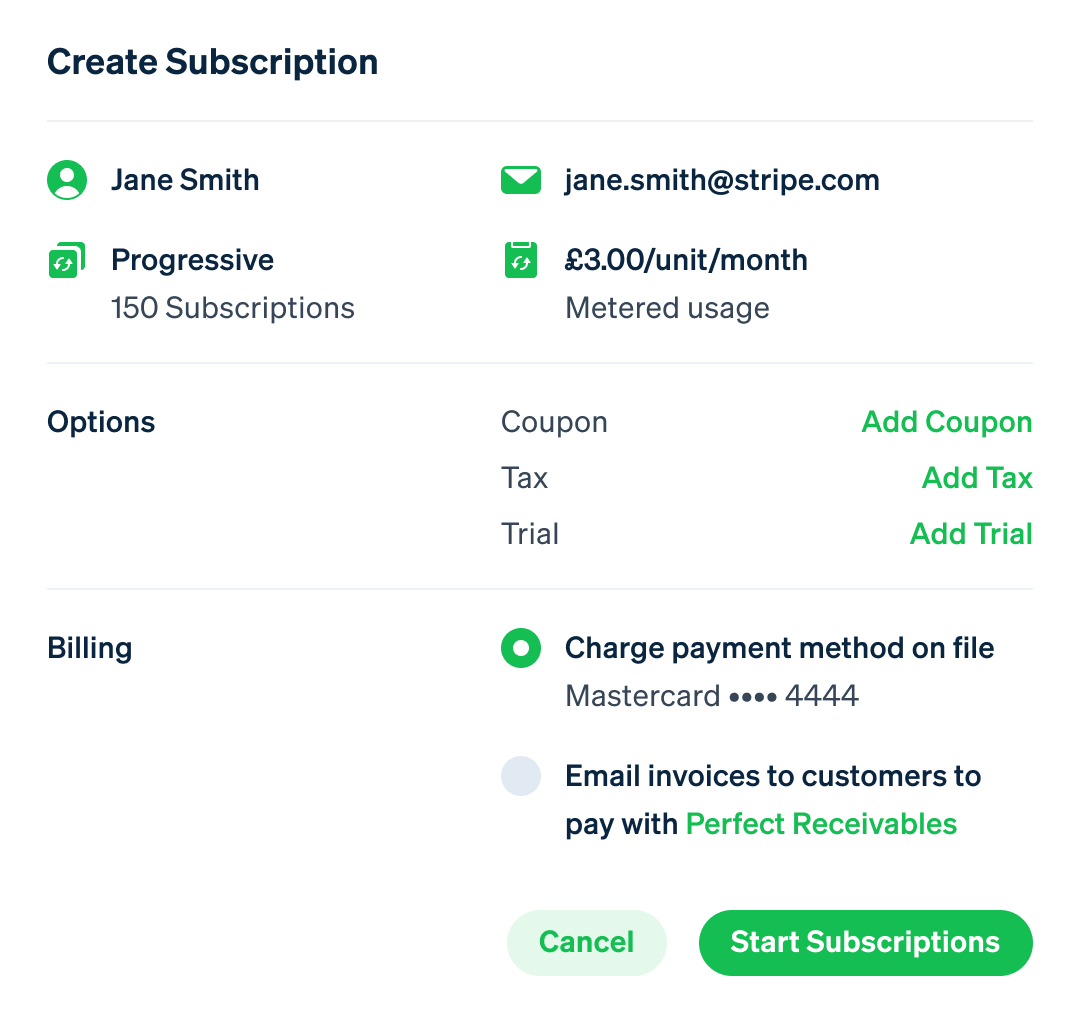

Test and roll out flat-rate, tiered, usage-based, or hybrid subscription plans – no custom code required.

Easily manage recurring billing

Set up and manage customer subscriptions, renewals, trials, and more with automated workflows and customer portals.

Optimise revenue recovery

Recover failed payments with Smart Retries and recovery flows that saved $6.5B+ for businesses in 2024.

Centralise revenue data

See subscription data in one place and close books more efficiently.

Why Stripe

Low-code subscription management that scales with your business

Stripe helps businesses monetise faster, with fewer resources. From no-code tools to API flexibility, your teams can:

- Move fast without compromising on customisation

- Migrate from legacy systems with minimal downtime

- Launch new products without rewriting your billing logic

Scale with confidence

Built for both B2B and B2C businesses

Stripe powers SaaS subscriptions, platforms, and commerce businesses of every size. For everything from managing complex enterprise billing to growing a self-serve product, Stripe gives your teams the flexibility to move fast and the reliability to support long-term growth.

Accept subscriptions globally

Stripe supports 135+ currencies, 40+ languages, and local payment methods, with real-time conversion and global tax handling built in.

Flexible pricing models

Change of plans? Stripe lets you adjust without relying on custom code or long release cycles. Evolve without outgrowing your tooling.

Revenue optimisation

Maximise revenue recovery

For every dropped payment, expired card, or failed invoice, Stripe has tooling to try to recover it. Instead of chasing revenue and leaving money on the table, let Stripe Billing handle the follow-up work with:

Subscription management FAQs

Ready to start managing subscriptions?

Get started with Stripe Billing and reduce time to market, churn, and operational complexity – all while increasing revenue and global reach.

Unlock growth with Billing

Launch faster, bill smarter, and stay focused on building – not babysitting your back end.