Stripe launches Stripe Treasury in major expansion of financial services offering for platform partners

- Stripe now enables platforms to embed financial services, enabling their business customers to easily send, receive and store funds.

- Shopify expands its partnership with Stripe to power Shopify Balance, the business account that will be built specifically for independent businesses and entrepreneurs.

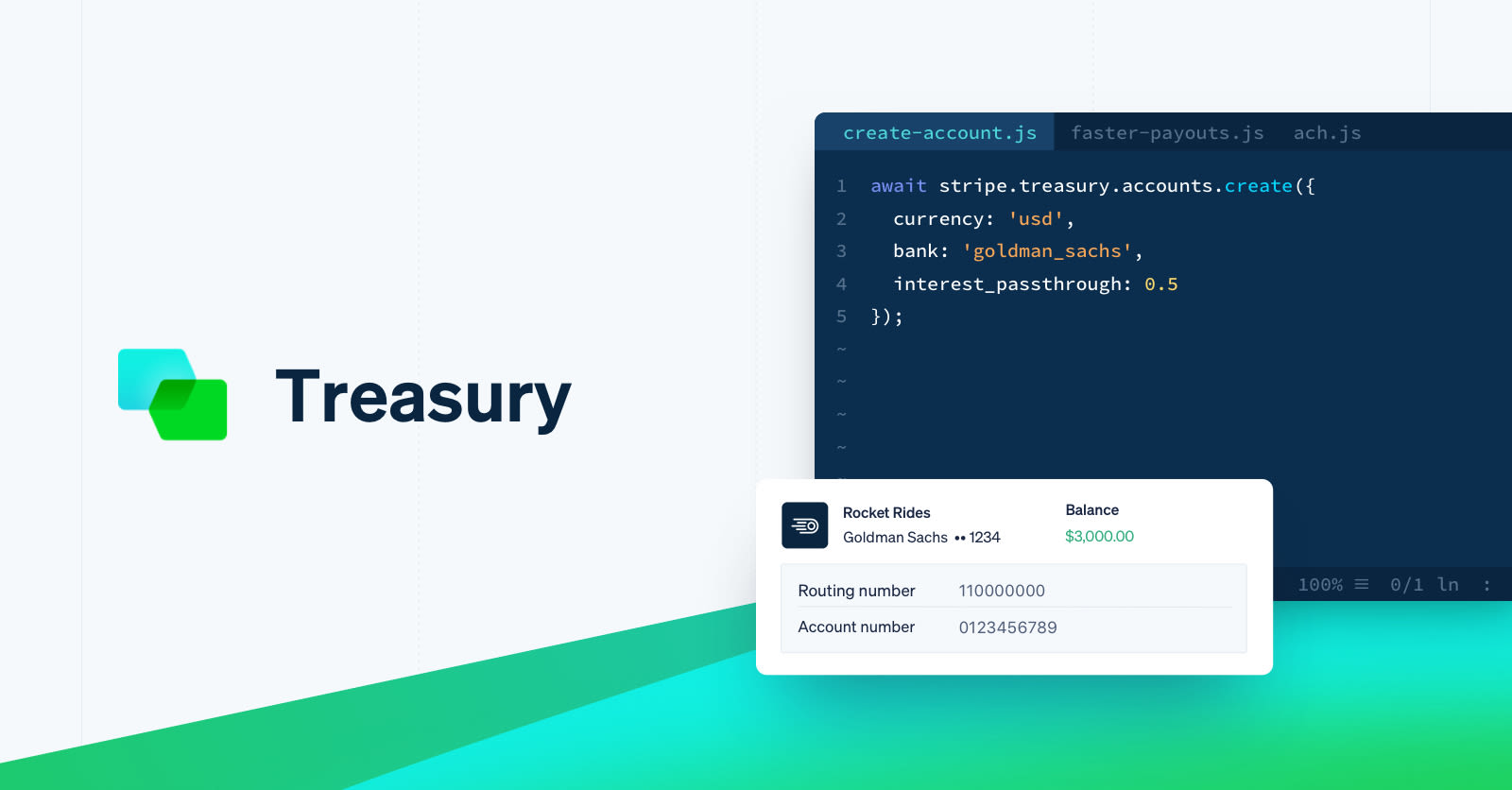

- Stripe is enabling standardized access to banking capabilities via APIs by expanding its bank partner network to include Goldman Sachs Bank USA and Evolve Bank & Trust as US partners.

- Stripe is also developing its bank partner network with Citibank N.A. and Barclays as global expansion partners.

SAN FRANCISCO—Stripe, the technology company building economic infrastructure for the internet, today announced that it is launching Stripe Treasury. This gives Stripe’s platform users powerful APIs to embed financial services, enabling their customers to easily send, receive and store funds.

Shopify is partnering with Stripe and Evolve Bank & Trust to build Shopify Balance, the business account designed to help merchants take control of their finances. Stripe Treasury is a leap forward for Stripe’s platform partners, who can now greatly extend—along a critical dimension—the level of support they provide to their users. As Stripe continues to invest heavily in its treasury infrastructure, it will deepen its new partnership with Goldman Sachs to add even more functionality to Stripe Treasury in the US next year.

Stripe launches banking-as-a-service software for platforms in the US

For businesses today, accessing financial services can typically involve a series of bureaucratic hoops and a lengthy application process. According to recent Stripe research*, setting up a bank account takes 5 and a half days on average (and 7 days on average for online businesses), around one in four (23%) businesses have to send a fax to open an account, and over half (55%) of businesses are required to visit a branch in person to open a bank account. Financial services simply weren’t designed for the modern internet, and this is a pain point for businesses today: nearly half (46%) of companies report that their banking experience has hindered their company growth.

This kind of off-line banking experience is increasingly incongruous in a world where 76% of businesses use an industry-specific software platform to manage their business, a figure that increases to 92% for businesses with more than 500 employees. The feedback from Stripe’s users is that they want a digital solution for financial services available directly within the software platform that powers their operations. On the flipside, Stripe’s platform customers are increasingly looking to embed financial services into their own product, but oftentimes face barriers to doing so.

Stripe Treasury removes some of these barriers, enabling platforms like Shopify to easily offer its merchants access to critical financial products to manage their businesses’ finances. With Stripe Treasury, platforms can offer their users interest-earning accounts eligible for FDIC insurance in minutes, enabled by Evolve Bank & Trust. Platform business customers can have near-instant access to revenue earned through Stripe, spend this directly from their balance with a dedicated card, transfer it via ACH or wire transfer, pay bills, and more.

“Everything about running an online business has been transformed by technology, but business banking has largely been left behind,” commented Karim Temsamani, Head of Banking and Financial Products at Stripe. “But we’re changing this, just like we set out to change payments a decade ago. Offering a user-centric banking experience should be as easy as spinning up a virtual server—that’s what we’re starting to accomplish at Stripe with our bank partner network.”

“Together, Stripe and Goldman Sachs are focused on relieving the frustrations internet businesses find in making banking work for them,” said Hari Moorthy, Goldman Sachs Global Head of Transaction Banking. “The millions of ambitious, fast-growing businesses in the Stripe ecosystem will soon discover a dramatically improved end-to-end digital banking experience.”

Shopify puts customers in control of their finances with Stripe

Stripe is expanding its partnership with Shopify to power the Shopify Balance Account and the Shopify Balance Card, enabled by Evolve Bank & Trust. For independent businesses and entrepreneurs using Shopify, this puts all their finances in one place, and gives them the tools to manage cash flow and business spend so they can grow faster.

“At Shopify, we’re focused on reducing the barriers to entrepreneurship. As part of that mission, we will soon launch Shopify Balance to empower our merchants to take control of their finances,” said Tui Allen, Senior Product Lead for Banking at Shopify. “We’re excited to partner with Stripe to provide our merchants with critical financial tools and products for their banking experience, specifically designed for their businesses’ financial needs.”

Stripe expands its bank partner network

Stripe already partners with over 50 financial institutions and interacts with thousands more, moving hundreds of billions of dollars securely for millions of businesses around the world, from enterprises like Salesforce and Zoom Video Communications, through to the startups and entrepreneurs just getting started.

Stripe is enabling standardized access via APIs to the global banking capabilities of its bank partner network, which now includes Goldman Sachs Bank USA and Evolve Bank & Trust as US partners, and Citibank N.A. and Barclays as global expansion partners. And through Stripe, these banks are able to extend their reach to millions of businesses.

“We are pleased to partner with Stripe leveraging Citi Virtual Accounts to offer consistent, scalable and ubiquitous payment solutions across Citi’s unparalleled global footprint. Our vision is for this partnership to fuel global commerce by enabling Stripe to launch the next generation banking proposition for their clients,” said Manish Kohli, Global Head of Payments and Receivables, with Citi’s Treasury and Trade Solutions.

*Survey conducted in partnership with Savanta among 1,000 small to medium-sized businesses in the US about business banking experiences