Vertical SaaS benchmarks for growth, fintech and AI

Learn what's driving growth in vertical SaaS. Based on data from 200+ vertical SaaS companies, the 2025 Tidemark benchmark report – featuring Stripe – shows how industry leaders are growing by diversifying their products, integrating payments and monetising AI.

2025 Tidemark Vertical & SMB SaaS Benchmark Report

12 minute read

10 pages

Explore key trends driving vertical SaaS growth

Inside the report: Benchmark your business and drive product innovation

What's inside:

- Benchmark your growth, retention and CAC against 200+ vertical SaaS companies.

- Find out why multiproduct platforms have 10x the addressable market and grow 21% faster.

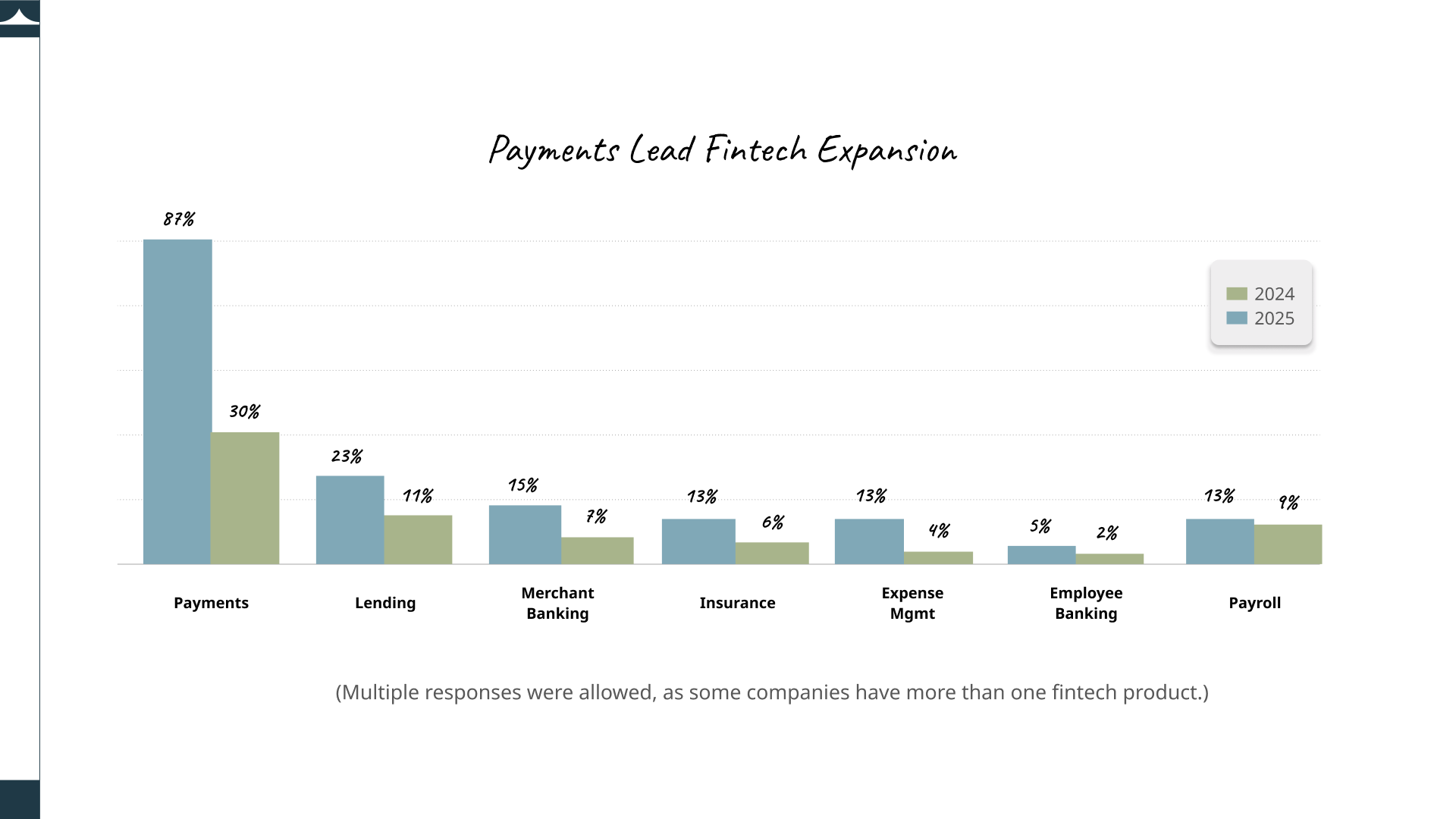

- Learn why fintech is the number one expansion play for 45% of companies as they launch a second product.

- Discover how platforms that offer AI products are outpacing the market in growth by 8 percentage points.

Data-driven insights

Shaping the future of vertical SaaS

See what sets top-performing vertical SaaS companies apart.

- Going multiproduct. It can more than double a SaaS platform's addressable market, with the median jumping from $250M to $513M.

- Embedding payments. The median payments attach rate has doubled in 1 year, and 87% of companies offering fintech services also provide payments—a leap from 30% last year.

- Deploying AI to stay competitive. Around 84% of vertical SaaS companies could have AI functionality by the end of 2025.

Why Stripe

The complete financial stack for startups

Everything you need to get started fast

The best way to test customer willingness to pay and find product market fit with Stripe Payment Links and Stripe Invoicing. These two hosted payment options enable you to accept one click payments or get paid via Email.

Grow your business with Stripe

No matter your business model – SaaS, direct-to-consumer e-commerce, platform, marketplace – the Stripe platform applies intelligent optimisations based on billions in transactions to help block fraud and maximise revenue.

Go global with Stripe

Launch new markets, currencies, and payment methods – with minimal changes to your code. Stripe handles all cross-border money movement and currency conversion so you and your users receive payouts in your local currency.

Do more with the full suite

Set up advanced fraud protection, automate tax and VAT calculation, verify identities, analyse business data, increase conversion, mitigate churn, and much more.

2025 Tidemark Vertical & SMB SaaS Benchmark Report

2025 Tidemark Vertical & SMB SaaS Benchmark Report

12 minute read 10 pagesThank you

Check your email for a PDF of the report.

Ready to get started? Get in touch or create an account.

Access a complete payments platform with simple pricing or contact us to design a custom package specifically for your business.