Risk controls

Adjust how aggressively you block fraud for your business with Radar for Fraud Teams.

To adjust the default risk score for blocking payments, use Radar for fraud teams. Go to the Radar risk controls page to make your adjustments.

The risk settings dialog shows your block threshold, your dispute rate, and other important statistics

How it works

Stripe Radar gives each charge a numerical risk score between 0 and 99, where 0 is the lowest risk and 99 highest.

Blocking payments

The default blocking threshold is 75, meaning Radar blocks charges with a score of 75 or higher. If you decrease your threshold, you’ll block more payments.

You need to make sure the default block rule or an equivalent custom rule is enabled for Radar to block transactions based on this threshold.

Manual reviews

The default manual review threshold is 65, meaning Radar sends charges with a score of 65 or higher to manual review. Changing the blocking threshold automatically changes the manual review threshold accordingly.

For Radar to send transactions to manual reviews based on this threshold, you need to enable the default review rule or equivalent custom rules.

Adjusting your threshold

When you change your blocking threshold, you see the following statistics:

| Metric | Description |

|---|---|

| Estimated fraud volume that is blocked or allowed | The estimated volume of fraudulent payments that will be blocked or allowed at the new blocking threshold. |

| Estimated good volume that is blocked or allowed | The estimated volume of good payments that will be blocked or allowed at the new blocking threshold. |

| Estimated previously blocked volume that is blocked or allowed | The estimated volume of previously blocked payments that will be blocked or allowed at the new blocking threshold. Because these payments were blocked and never processed, some of these payments might be fraudulent. |

| Fraud rate by volume | The percent of payments by volume that have received a dispute, an Early Fraud Warning (EFW), or were refunded as fraud. |

| Block rate by volume | The percent of payments by volume that were attempted but were blocked by Radar or by Stripe. Payments are blocked by Stripe to protect you from card testing and other risks that affect all users, regardless of your usage of Radar. |

When to use it

You can customize the default threshold to fit your own business needs. Setting the risk score threshold requires you to consider a tradeoff between how much fraud Radar blocks and how many payments it allows.

Block more fraud

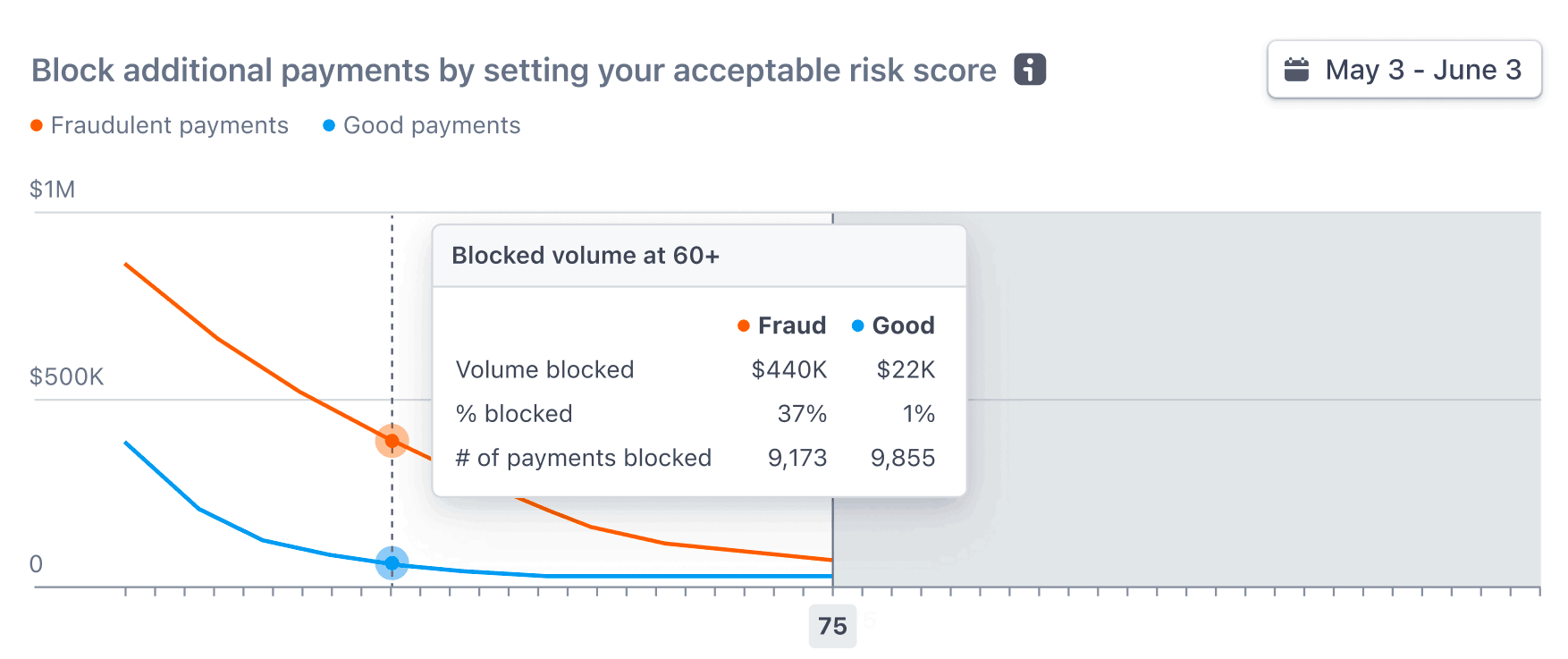

If your business is experiencing higher rates of fraud, you can decrease the score for blocking payments. To determine what risk score is right for your business, hover over the Block additional payments by setting your acceptable risk score chart.

This chart shows how many fraudulent and good payments you would’ve blocked if you set your threshold at that risk score. Here, you can see:

| Metric | Description |

|---|---|

| Volume blocked | Volume of fraudulent and good payments would be blocked. |

| % blocked | The percent of fraudulent and good payments that are blocked respectively. For example, blocking at 65 would result in 55% of your fraud getting blocked at the expense of only 1% of good payments. |

| # of payments blocked | Number of fraudulent and good payments would be blocked. |

Ultimately, it is up to your business to decide what tradeoff you’re willing to accept in terms of how much fraud versus good payments you block.

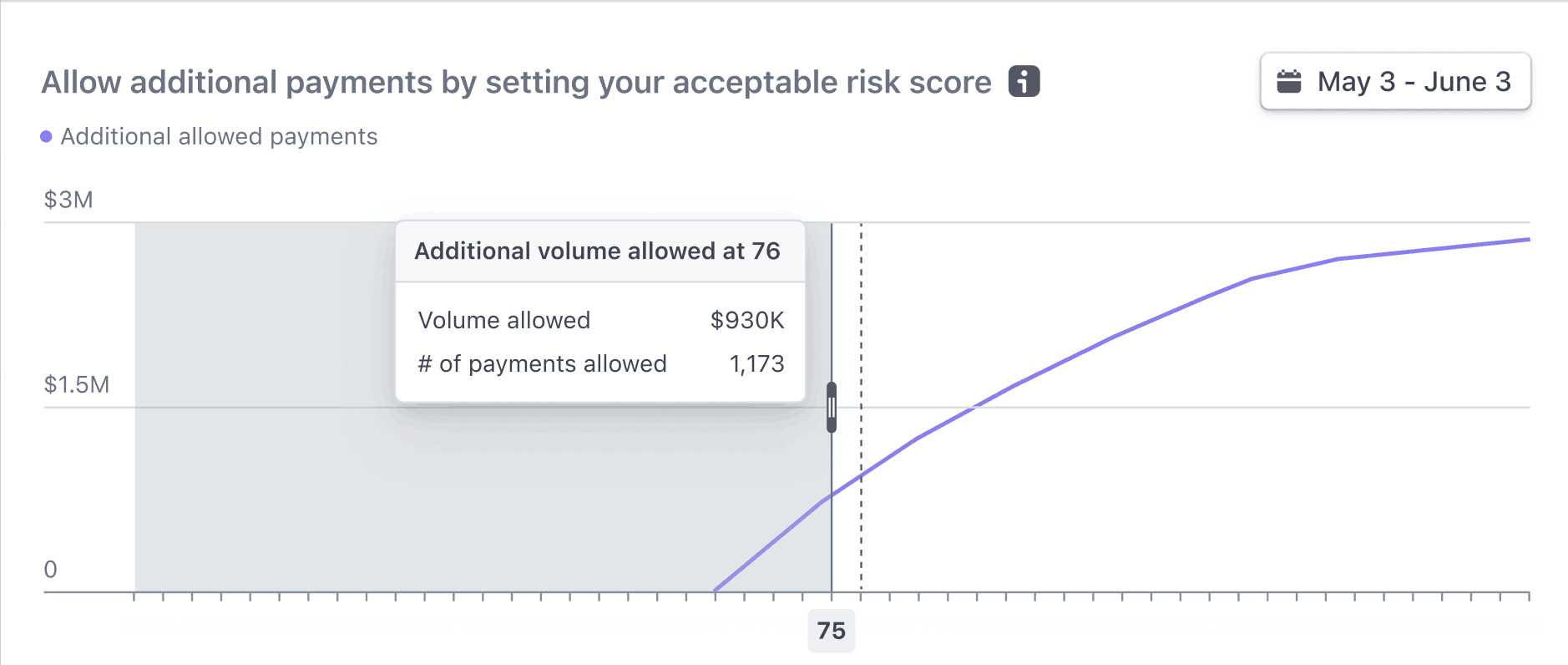

Allow more payments

If your business has low fraud rates and costs, you might want to increase the default blocking score so that you can allow more payments overall.

This chart shows how many payments you would allow if you set your threshold at that risk score. Here, you can see:

| Metric | Description |

|---|---|

| Volume allowed | Volume of payments would be allowed. |

| # of payments allowed | Number of payments that would be allowed. |

If you’re increasing the risk score for blocking charges, we can’t accurately predict the impact of this change on your fraud rate (as some charges that were previously blocked will now be allowed). Be careful when adjusting the risk score in this direction.