Best practices for setting up invoices in Japan

Learn the best practices for setting up invoices in Japan.

Last updated November 7, 2024

Legal Disclaimer

The information on this page is for your general guidance and isn’t legal advice.

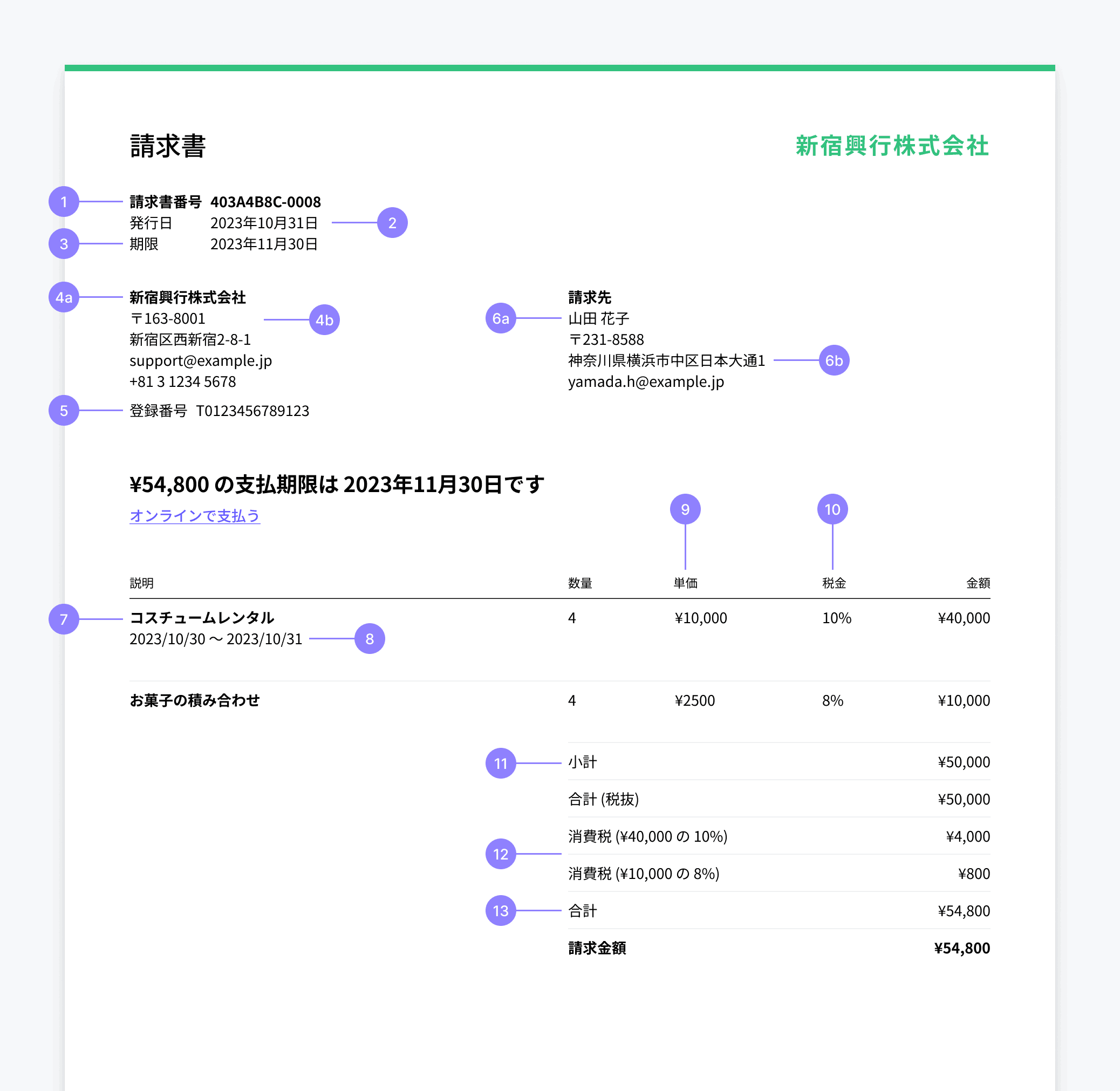

We recommend the following best practices when you make sales to business customers because Business-to-Business (B2B) sales require compliant invoices (適格請求書等) under the Qualified Invoice System (適格請求書等保存方式, also known as インボイス制度) in order for the purchaser to claim a tax credit. Registered businesses (適格請求書等発行事業者) can issue this type of invoice. There’s no obligation to issue invoices for Business-to-Consumer (B2C) sales.

We don’t automatically populate all of the fields on an invoice. In Japan, a missed or improperly added field can render an invoice noncompliant. If you intend to utilize the Qualified Invoice System, make sure that you include the required fields when you prepare your invoices.

You can use tax calculation with Stripe Tax or Tax Rates to assist with including tax information in your invoices.

How to add an invoice field

The following table explains the ways that you can populate different invoice fields with reference to the Qualified Invoice System. To make sure that your invoices are compliant and adhere to applicable geographic requirements, we recommend that you consult with your tax and legal advisors.

| Key | Field | Requirements | How to populate |

|---|---|---|---|

| 1 | Invoice number | There’s no requirement to show invoice numbers. | Stripe populates this by default. You can change how invoices are numbered (customer or account level) in the Invoice template. |

| 2 | Date of issue | You must use this field to list the transaction date (取引年月日), or set line item supply dates. | Stripe populates this by default. |

| 3 | Date due | While there’s no requirement to display the date that a customer must pay an invoice by, it’s a best practice to do so. | Stripe populates this by default. |

| 4a | Business company name (適格請求書発行事業者の氏名又は名称) | This is required. | Stripe populates this by default from the value in Public business information section of the Dashboard. |

| 4b | Business company address | There’s no requirement to display your address. | Enter your Support address under Public business information. You can also default to your business address as listed in your account settings. |

| 5 | Business registration number | Invoices require a business registration number (適格請求書発行事業者の登録番号). | You must add your business registration number as JP TRN in your invoice settings. Then, each time you create an invoice, you must set it as your Tax ID under Additional options. |

| 6a | Recipient name (書類の交付を受ける事業者の氏名又は名称) | This is required. | Stripe populates this by default from the Customer details. |

| 6b | Recipient address | There’s no requirement to display the recipient address. | You can add this field by clicking the Additional details button when you first create a customer. |

| 7 | Name of the good or service (取引内容) | This is required. | Stripe populates this by default from the Invoice Items. |

| 8 | Invoice line item supply date (取引年月日) | This is required when the supply date of individual line items is different from the invoice send date. | You can display line item supply dates by clicking the toggle under Item options. |

| 9 | Price of the good or service | It’s considered a best practice to show the unit price, quantity, and total payable amount for each invoice line item. | Stripe populates this by default. |

| 10 | Invoice line item tax rate percentage | This is required to indicate if an item is subject to the reduced tax rate (軽減税率). It’s sufficient to display the tax percentage amount for an invoice line item. You aren’t required to display the cash amount of the tax per invoice line item. | Determine the tax to display on an invoice using either of the following methods:

|

| 11 | Invoice subtotal (excludes tax) | This is required. | Stripe populates this by default. |

| 12 | Total tax amounts and rates (税率ごとに区分して合計した対価の額、適用税率、消費税額) | This is required and must include the total tax amount per tax rate. | Stripe populates this by default. |

| 13 | Invoice total (includes tax) | This is required. | Stripe populates this by default. |

Facilitate customer payment

After you set up your invoices to meet Japanese requirements, you can facilitate customer payment by:

- Adding the most popular Japanese payment methods. By accepting a wider range of payment methods, such as Bank Transfers, you can lower your costs and increase conversions (especially with large customers).

- Using the Hosted Invoice Page.

- Localizing your Invoices to the language of your customers.

- Allowing a single invoice to be paid over multiple due dates. By reflecting a payment schedule, you can extend more flexible net terms or collect a deposit.

If you provide a financial product or service, please consult with your legal advisors regarding applicable restrictions and requirements before setting up invoices. Installment payments, lending, credit, and Buy Now Pay Later services are subject to regulation in Japan and you may need to register or obtain approvals before engaging in those services.

Refunds (適格返還請求書)

If you need to produce a refund document (適格返還請求書) for your customer, you can issue a credit note. If you’ve completed the steps above to create invoices with the necessary fields, such as your business registration number (適格請求書発行事業者の登録番号), the credit notes will also contain them.

Connect platforms

Make sure your connected account’s invoices contain the necessary information required by the Qualified Invoice System, such as the account’s tax ID and business details. You can configure the information shown on invoices and receipts that Connect creates.

If you use manual taxes on invoices, configure the taxes to round after subtotaling, rather than at the line item level. This setting applies to all invoices generated across your connected accounts and across different geographies.