Revenue Recognition accounting period control

Accounting period control allows you to configure how to close accounting periods. You can either manually close the books with all checks and adjustments finished each month, or you can let Stripe automate closing the books.

You can also reopen past accounting periods using accounting period control. This is useful when you first start using Revenue Recognition because it allows you to make adjustments to past data without creating corrections in the current period. For example, when you apply rules to fit Revenue Recognition with your own business model, it’s likely to change the history of closed accounting periods. You can decide on whether to reopen the closed accounting periods or make adjustments in the current accounting period.

Setting accounting periods

You can find the accounting periods section on the Revenue Recognition settings page.

Select the mode for accounting periods

To get started, select the mode for your accounting periods. The default is automatic.

| Mode | Descriptions |

|---|---|

| Automatic | Accounting periods automatically close at the end of each month. |

| Manual | You control when to close the accounting periods. |

Choose the latest closed accounting period in manual mode

When you set latest closed accounting period, you close the selected accounting period along with all previous accounting periods, and you open all following periods. You can choose one of the periods in the past 24 months, and you can also choose no closed accounting periods. For example, when you choose the latest closed accounting period to be February 2021 in manual mode, the accounting periods looks like the following example:

| Before Jan 2021 | Jan 2021 | Feb 2021 | Mar 2021 | Apr 2021 | May 2021 | Jun 2021 |

| Closed | Closed | Closed | Open | Open | Open | Open |

How accounting period control works

Controlling closing process for your accounting period cycle

Accounting period control allows you to configure the closing process with your own workflow for the accounting period cycle. You can choose the manual mode, and check all terms and fix the human errors before closing the accounting periods manually, or you can automate closing your Revenue Recognition book using the automatic mode.

Getting started with Revenue Recognition

If you’re new to Revenue Recognition, use accounting period control to get started. For example, when you apply rules to fit Revenue Recognition with your own business model, you can set manual mode with no closed accounting periods. In this way, all the changes go into the original accounting periods, which can help you understand your books.

You can open accounting periods after setting revenue recognition rules, unless you need to issue corrections. In that case, you must close the accounting period before setting any rules.

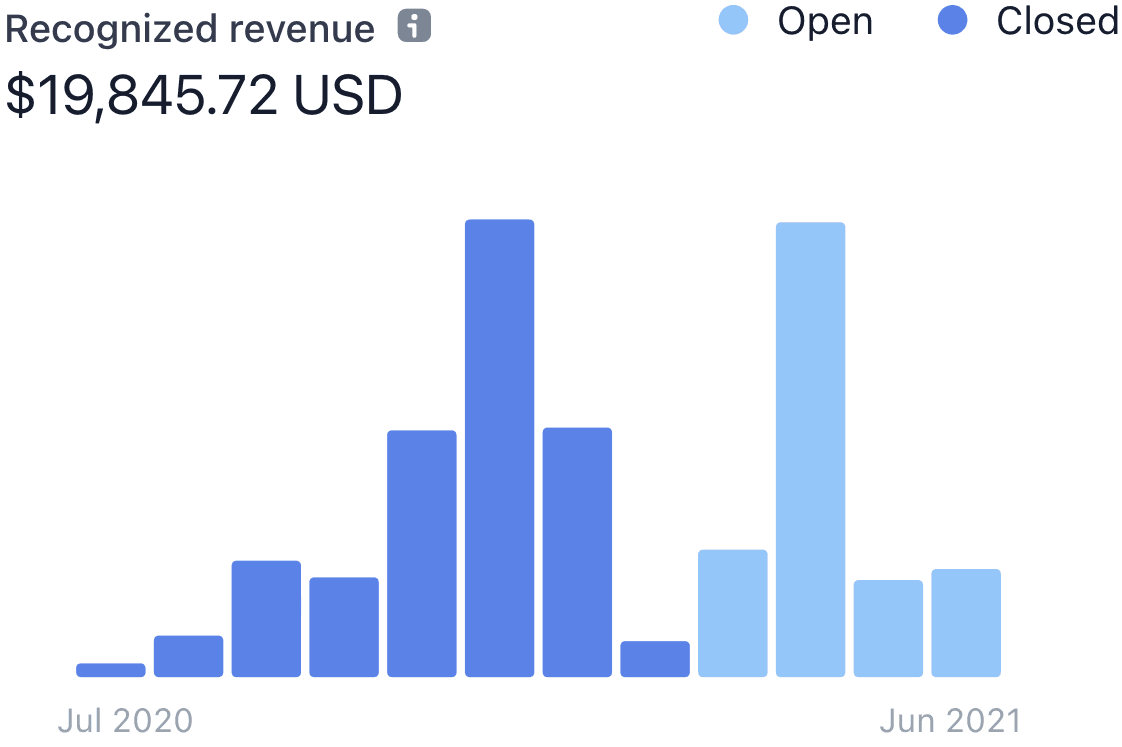

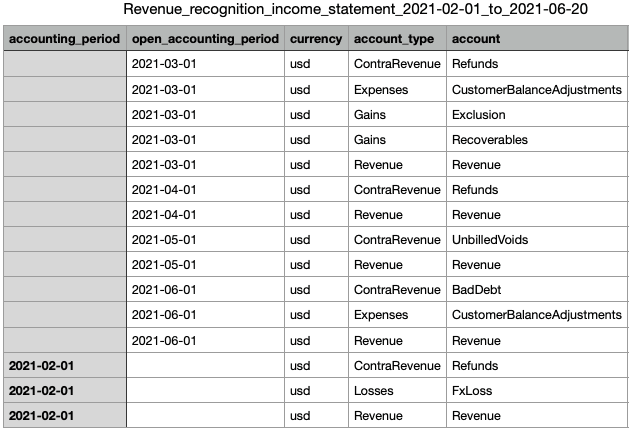

Adjustments for accounting periods take 48-72 hours to complete. When completed, you can see the setting in monthly summary charts and CSV-only reports in the Dashboard. For example, when you choose the latest closed accounting period to be February 2021 in manual mode, the charts and reports look like the following example: