Challenge

For the millions of people facing mental health issues, Lyra Health reimagines comprehensive mental health care by improving access to effective, high-quality care for employees and their families. Initially, employers paid Lyra for services, which then pays healthcare providers. But, as the company grew and customers wanted more flexibility for their employees, the transactional complexities of benefits, health plans, and member co-pays became a scalability challenge. With ease of access to care and member improvement remaining its highest priorities, Lyra knew it wanted to keep things as easy as possible for its customers and their employees.

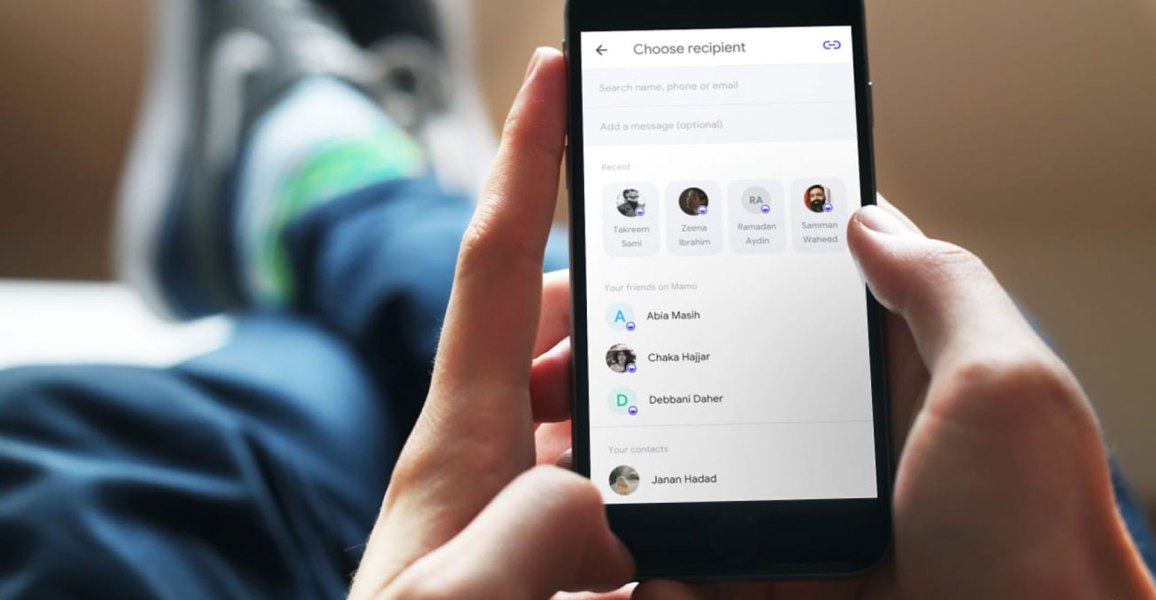

“We needed to grow beyond paying providers directly, which required enabling members to transition to their health plan co-pays, or even pay out-of-pocket once benefits ran out,” explained Mike Komadina, Product Manager, Lyra Health. “Our challenge was to make this an easy transition for members while not putting the payment collection burden on our large network of providers.”

Lyra held the important responsibility of delivering much-needed mental health support to employees of the world's leading employers. But to do so effectively, it had to integrate reliable, scalable payments infrastructure that could handle complex healthcare transactions while maintaining simplicity for the member payments and provider payouts experience on its platform.

Solution

Early in its history, Lyra settled on Stripe as the platform to handle payouts to providers of all sizes. “Stripe Connect made it very easy for new therapists to join our network,” explained Komadina. “It’s a scalable way to manage payments for both small, individual practices all the way to larger groups—regardless of their technical capabilities.”

As Lyra grew to add more services for more customers, it didn’t want to add complexity to its own technical infrastructure. Extending a single payment platform to handle both member and provider transactions was the logical answer, and after evaluating multiple point solutions, Lyra chose Stripe as a unified solution for its needs. Komadina added, “Stripe allows our members to simply sign up. Stripe Payments lets us securely store credit card info for future use, which is a huge benefit. And, we don’t have to set up new financial relationships with providers when members switch from their EAP to their health plan or out-of-pocket payments. Because it’s all on one platform, Stripe makes it seamless.”

Results

Using Stripe as its single payments platform gives Lyra the confidence and reliability necessary to scale its fast-growing business. As the company continues its rapid expansion, Lyra can focus on its mission of transforming mental health care knowing Stripe is engineered to power its growth.

As we grow, we really need a payments partner where we could have confidence in both the scalability and reliability. Stripe offered all that, plus

it’s a single, unified platform for charging members and paying out to providers.

+150% provider network growth, with Stripe scaling to support payments to 5,300+ providers

“As we grow, we really need a payments partner where we could have confidence in both the scalability and reliability,” said Mike Komadina, Product Manager, Lyra Health. “Stripe offered all that, plus it’s a single, unified platform for charging members and paying out to providers.”

+200% increase in provider transactions and +300% growth in members with no integration changes

Komadina said, “We work with a lot of technology providers. Stripe has been responsive and professional in supporting our growth, and has been there as we've evolved our business model. It comes back to reliability and stability, and Stripe has really excelled.”

Integrated and deployed consumer payments capabilities in just a few weeks

“Stripe’s support team is great for startups like Lyra,” said Komadina. “They are very good at advising us on payments best practices, implementation and technology, and everything else. We can explain our vision and Stripe helps us map it to their products, and that is a real positive for us.”

As we grow, we really need a payments partner where we could have confidence in both the scalability and reliability. Stripe offered all that, plus it’s a single, unified platform for charging members and paying out to providers.