Sessions 2022 and product highlights from the year

Today, we kicked off our annual user conference—Stripe Sessions. You can now watch the keynote and breakout talks on demand.

In the keynote, several of our users shared what they’re seeing and facing in the internet economy today and how they’re using Stripe to adapt. We also shared product updates and releases, including the launch of Stripe Apps.

We weren’t able to cover all of our updates from the past year in the keynote, so we’ve put together a summary of what’s new. We hope it’s helpful—please let us know if you have any feedback or thoughts on what else you’d like to see.

Global payments platform

We made several updates to manage the growing complexity of online payments, including new ways to boost conversion, improve payments performance, and unify in-person and online experiences. On that note, we’re honored to have been recognized as a leader in the 2022 Forrester Wave: Merchant Payment Providers report. Stripe was named a “best fit for technology-forward payment teams or for digital-first or digital-only merchants that are intent on innovating on their business model."

Getting started—and checking out—with Stripe is easier than ever.

- We launched the Payment Element, an embeddable UI component that supports 20+ payment methods with a single integration.

- Checkout is more customizable—you can now change colors and fonts to match your brand, and use your own domain to make the transition from your website to Checkout seamless. You can also surface products as suggested add-ons to an order, allow customers to adjust order quantities, and enable upgrades from monthly to annual subscriptions.

- We added capabilities to Payment Links, including the ability to turn payment links into QR codes, include multiple products or subscriptions, and add URL parameters to prefill information or improve tracking and attribution. We built an API so you can create payment links at scale.

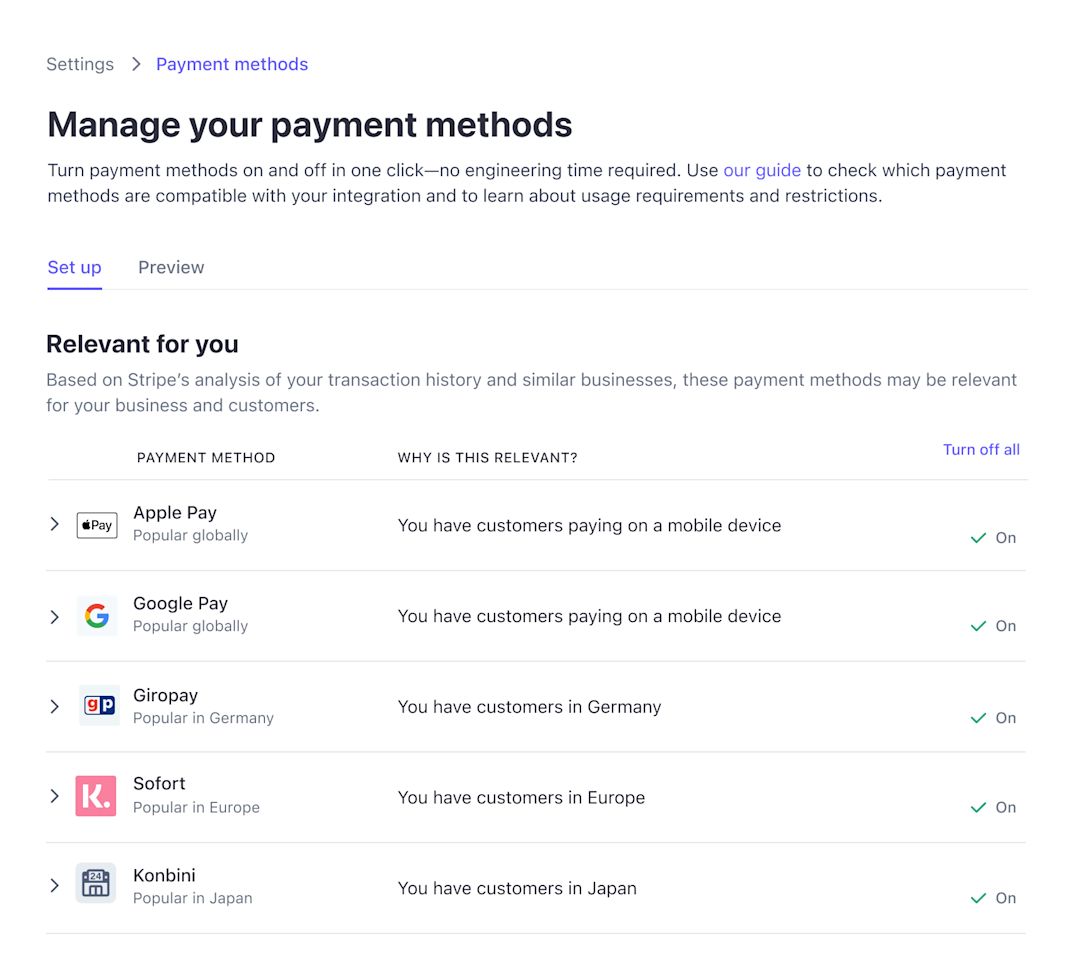

- For Checkout, Payment Links, and Payment Element users, we added the ability to toggle 20+ payment methods on and off from the Dashboard without having to update your UI, eliminating the need to build custom logic to set up and maintain each payment method.

One-click payment methods in the Dashboard

A critical piece of optimizing conversion is allowing your customers to pay how they want to pay. We added several new local payment methods and expanded their availability to more users.

- We overhauled ACH debits in the US and added instant bank account verification. It works with any way you choose to integrate Stripe.

- We’re making Link available to Elements users, who will be able to increase conversion by enabling customers to check out faster. Millions of consumers around the world are already using Link through Checkout and completing purchases 4x faster than non-Link customers.

- We expanded the availability of buy now, pay later options, with more users now able to access Afterpay and Klarna, and soon Affirm.

- We’re making local bank transfers easier around the world, starting with Japan and coming soon to Mexico, Europe, and the UK.

- Businesses in the US, UK, Europe, and most of Asia can now reach over a billion Chinese buyers through UnionPay and WeChat Pay.

- We added Konbini payments in Japan, covering over 34,000 convenience stores through a single Stripe integration.

- We added support for payment methods in Southeast Asia, such as GrabPay in Singapore and Malaysia.

- We’re adding support for more national payment schemes across Asia-Pacific, including PayNow in Singapore, PromptPay in Thailand, UPI in India, and NPP (PayTo) in Australia. You can learn more about the growing trend of national payment schemes in our Sessions breakout talk on the global power of local payment methods.

For high-volume businesses, we beefed up our fraud toolkit, improved authorization rates, and maintained enterprise-grade reliability.

- We expanded the rule set for Radar for Fraud Teams with dozens of attributes to help users fight fraud using more fine-grained rules and controls. Radar for Fraud Teams users can get deep insights into rule performance, including how many blocked payments and estimated false positives your rules have generated.

- Radar now provides benchmarks so you can compare your fraudulent dispute, false positive, and block rates to other businesses in your region or in similar industries.

- We launched the first version of a new intelligent card verification feature, which will be widely available through Radar for Fraud Teams later this year. Instead of blocking potentially fraudulent charges, customers will be asked to scan a picture of their credit card and Radar will determine whether the card is real in less than a second. Watch the Sessions keynote to see how it works.

- To improve authorization rates, we launched Network Tokens, which keep card information up to date and reduce friction for recurring customers. Businesses in the US, Canada, Australia, and New Zealand are already seeing these benefits, and we’ll expand to additional countries later this year.

- We’ve continued to maintain 99.999% uptime since this time last year, including Black Friday and Cyber Monday.

We made a bunch of updates to Stripe Terminal to better help businesses create online and in-person payment flows.

- Terminal is now available in 15 countries. We added new reader options as well as features to help businesses across industries, such as tipping for hospitality.

- We made it easier to get started with Terminal no matter your stack with the server-driven integration, which lets you use the Stripe API in place of platform-specific SDKs.

- In our Sessions keynote, we previewed our next Stripe-designed card reader, a smart reader that enables businesses to accept payments and run custom Android apps from a single device.

We expanded the availability of Stripe to more businesses globally.

- We added support for crypto businesses to process payments for fiat currencies through a single integration—with fraud prevention and authorization optimization built in.

- Stripe is now available in 47 markets and launched in beta in Indonesia and Thailand, the two biggest economies in Southeast Asia. We’ll also soon complete our coverage of the European Union with the addition of Croatia, and we are adding support for Gibraltar and Liechtenstein.

Revenue and financial management

We’re building a modern operating system for finance that can grow with your business, adapt as inevitable changes arise (like new pricing or product lines), and automate tedious tasks without sacrificing data integrity.

- We just launched Stripe Data Pipeline to enable businesses to analyze all their data in their Snowflake or Amazon Redshift data warehouse. Businesses simply connect their account in the Dashboard, and all their Stripe data and reports will be synced to their data warehouse.

- Stripe Sigma now supports out-of-the-box reports, such as the Activity Report, Balance Report, and Payout Reconciliation Report, so you can close your books faster. We also added additional data sets, such as radar_rules and rule_decisions, and will continue to add more data in the near future.

- The Recko team joined Stripe to help customers automate payment reconciliation, get visibility into money movement, and close the books faster with fewer discrepancies.

- Stripe Billing helps businesses implement recurring revenue business models with flexible APIs and powerful hosted surfaces to get up and running faster. Users can get started quickly with Checkout’s prebuilt subscription page and a new subscription upsell feature. The customer portal now includes both recurring transactions and one-time invoices, and businesses’ users can add free-form reasons when canceling a subscription. Plus, this year we introduced test clocks, which allow users to simulate changes over time to a subscription.

- We honed our smart retry tools to recover more revenue—including the ability to retry payments more frequently. Last year, Stripe helped businesses recover 38% of failed recurring transactions.

- To help streamline the quote-to-cash process, we launched quotes, which enable businesses to share a price estimate with a customer and later convert it to an invoice or subscription. We’re working on a Salesforce connector to enable sales teams to create subscriptions right in Salesforce.

- The Billing Scale package now includes the tools needed to automate revenue operations, including Invoicing Plus and Revenue Recognition.

- Stripe Revenue Recognition gives a real-time view of revenue, whether you’re just getting started or you’re a public company complying with ASC 606 and IFRS 15. We added support for data import and have new features coming soon for businesses that use contracts or bundled pricing.

- Stripe Invoicing automates everything from the hosted invoice payment page to collections and reconciliation on the back end. In the past year, we added support for streamlined ACH direct debit payments, enabled scheduled payments, automated tax collection, and added the ability to set the due date to “today.” Seventy percent of Stripe invoices are paid within 24 hours.

- We also put together a guide to help users configure invoices in Europe and a quick start guide to using the Invoicing API.

- Stripe Tax simplifies sales tax and VAT collection globally. In the last year we launched in seven markets, including Canada, Japan, Hong Kong, Singapore, Iceland, and the UAE, bringing the total to 39 markets. We added support for nearly all payment integrations, including Payment Intents. Stripe Tax works right out of the box, and businesses can monitor tax obligations for free right in the Dashboard.

Connect and global payouts

More than 10,000 software platforms, marketplaces, and enterprises use Stripe Connect to power their businesses. In the past year, we expanded coverage to provide more payment options around the globe, developed features to offload the burden of filing taxes, and rolled out platform tools to make it easier to manage connected accounts.

- We introduced more flexibility into Connect payouts, so that users can pay sellers, freelancers, content creators, and service providers in their preferred currencies.

- We added cross-border payout options for more than 70 countries.

- We launched a new Express mobile app to give solopreneurs an easier way to track their platform earnings, see upcoming payouts, and manage cash flow.

- We also introduced crypto payouts, and you can watch the Sessions keynote to see how Twitter is using crypto payouts to help creators access their earnings.

We rolled out features to make it easier for Connect platforms to easily and accurately meet their 1099 tax reporting obligations.

- Platforms can generate and edit 1099 forms within the Dashboard. We handle e-filing and delivering copies to payees, as well as Tax Identification Number (TIN) verification checks.

- We made it easier for connected accounts—sellers, service providers, or independent contractors—to manage their taxpayer information and download copies of their 1099s through the Express Dashboard and Express mobile app.

We built workflow tools for platforms to more easily manage connected accounts.

- We introduced greater payout and pay-in controls for platforms to manage risk and fraudulent accounts within the Dashboard.

- Our modular connected account details page creates space for platforms to manage attached products, such as Capital and Treasury.

- We published a guide on risk management that helps software platforms reduce their risk exposure during onboarding, monitor risk levels, and mitigate threats.

Financial Connections and Identity

- We just launched Financial Connections, which lets businesses connect to their users’ bank accounts, verify bank accounts before sending payouts, check account balances before initiating debits, and confirm bank account ownership to minimize fraud.

- Since launching Stripe Identity last year, customers like Discord and Peerspace have used it to help with KYC, reduce fraud, and build trust in their communities or marketplaces. Customers are also using Identity to verify user identities in advance of large purchases or for regulated industries, such as car rentals. We’ve reduced response time to under three seconds and introduced new fraud tools to help platforms screen out bad actors.

Stripe Apps and new developer tools

This past year, we delivered new ways for developers to build with—and on—Stripe faster.

- Today, we’re launching the public beta of Stripe Apps, which allows developers to build apps directly onto Stripe and use the power of the Stripe API to listen for webhooks and read/write data. Watch the recording of our live Q&A for Stripe Apps developers to learn more.

- In the Stripe App Marketplace, you can browse the first 50+ apps, including DocuSign, Dropbox, Intercom, and Ramp, and get notified when they’re ready to install in the next few weeks.

- Earlier this month, we open-sourced Markdoc, the content-authoring system that powers Stripe Docs. Developers can now build documentation and static pages with the same tooling we use here at Stripe.

- We released developer experiences inside of Stripe Docs—such as integration builder, an interactive way to get started with the Stripe API, and Stripe Shell, a hosted terminal and graphical CLI right in the browser so developers can try the APIs as they read the docs.

- Building and testing your integration is faster than ever. Build, test, and use Stripe right inside VS Code with our new extension. And we now have a Stripe-maintained client library for React Native, too.

Fintech and embedded financial services

We’ve built a suite of banking-as-a-service (BaaS) products to enable companies to build modern financial services on top of traditional banking infrastructure.1 Users like Shopify, Jobber, and Ramp are using our BaaS APIs—Treasury, Issuing, and Capital—to create and embed cash management, issue cards, and provide access to loan offers in their own products.

- Developers can start issuing cards even faster by forking our GitHub sample. Inventory for custom-designed cards can be checked right from the Dashboard.

- Stripe Issuing is now available for UK businesses and last year we launched EU/UK contactless cards.

- We expanded our Capital loan coverage, adding financing options for users who have an active loan, improving our underwriting, and including a new offer size of $250K. Users can now link their bank accounts via Financial Connections to help increase their loan.

- Stripe Treasury powers Shopify Balance, which launched in January and is already supporting 100,000+ small businesses.

Building for the future

We’re always looking for new ways to help our current and future users grow with the expanding online economy.

- Stripe Atlas is making it much faster to start a company. We automatically check if your business name is available so founders can skip navigating complex government sites. We saved founders outside the US six months of waiting for business-critical tax IDs by calling the IRS on their behalf, and US founders now receive their EIN in just one business day (vs. 25 days) using newly automated filing. Since the beginning of the pandemic, we’ve saved founders more than 100 years of wait time. We also expanded access to teenagers, welcoming the next generation to the internet economy.

- We recently launched the Stripe Partner Ecosystem—a program that connects technology and consulting firms with Stripe users. Companies can find the right partners for their objectives and partners are equipped with resources for building products and services on Stripe’s infrastructure.

- To enable carbon removal purchasing at scale, we launched an organization called Frontier in partnership with Alphabet, Shopify, Meta, and McKinsey. Frontier—structured as an advance market commitment (AMC)—will facilitate nearly $1B of guaranteed, pre-committed carbon removal purchases over the next eight years, meaning we can enter into longer-term agreements with carbon removal companies.

And that’s a wrap—thanks for reading, and we hope you’ll watch some of our Sessions talks too.